Cablevision 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-42

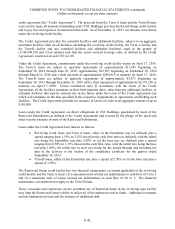

Under the Restricted Group credit facility there are generally no restrictions on investments that the

Restricted Group may make, provided it is not in default; however, the Restricted Group must also remain

in compliance with the maximum ratio of total net indebtedness to cash flow and the maximum ratio of

senior secured net indebtedness to cash flow.

There is a commitment fee of 0.30% on undrawn amounts under the revolving credit facility.

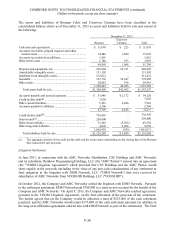

In connection with the new credit facility, the Company wrote-off deferred financing costs of $6,602

related to the repaid credit facility. The Term B loans were issued at a discount of $11,750 and the

Company recorded deferred financing costs of $27,080 related to the new credit facility. The original

issue discount and the deferred financing costs are both being amortized to interest expense over the term

of the respective loans.

The Restricted Group was in compliance with all of its financial covenants under the Restricted Group

Credit Agreement as of December 31, 2013.

AMC Networks Distribution

In connection with the AMC Networks Distribution in 2011, AMC Networks issued senior notes and

senior secured term loans under its new senior secured credit facility to the Company as partial

consideration for the transfer of certain businesses to AMC Networks. The Company exchanged the

AMC Networks senior notes and senior secured term loans in satisfaction and discharge of $1,250,000

outstanding indebtedness under its previous Restricted Group revolving loan and extended revolving loan

facilities.

Newsday LLC Credit Facility

On October 12, 2012, Newsday LLC entered into a new senior secured credit agreement (the "Newsday

Credit Agreement"), the proceeds of which were used to repay all amounts outstanding under its existing

credit agreement dated as of July 29, 2008. The Newsday Credit Agreement consists of a $480,000

floating rate term loan which matures on October 12, 2016 (net of the $160,000 repayment in December

2013, discussed below). Interest under the Newsday Credit Agreement is calculated, at the election of

Newsday LLC, at either the base rate or the eurodollar rate, plus 2.50% or 3.50%, respectively, as

specified in the Newsday Credit Agreement. Borrowings by Newsday LLC under the Newsday Credit

Agreement are guaranteed by CSC Holdings on a senior unsecured basis and certain of its subsidiaries

that own interests in Newsday LLC on a senior secured basis. The Newsday Credit Agreement is secured

by a lien on the assets of Newsday LLC and Cablevision senior notes with an aggregate principal amount

of $611,455 (after the sale of Cablevision senior notes in December 2013 discussed below) owned by

Newsday Holdings. In connection with the Newsday Credit Agreement, the Company incurred deferred

financing costs of approximately $4,558, which are being amortized to interest expense over the term of

the Newsday Credit Agreement.

On December 10, 2013, Newsday LLC made a voluntary repayment of $160,000 on its term loan with the

proceeds it received from CSC Holdings in connection with CSC Holdings' purchase of Cablevision

senior notes with an aggregate principal amount of $142,262 held by Newsday Holdings. The senior

notes were subsequently distributed by CSC Holdings to Cablevision and were canceled.

The principal financial covenant for the Newsday Credit Agreement is a minimum liquidity test of

$25,000 which is tested bi-annually on June 30 and December 31. The Newsday Credit Agreement also

contains customary affirmative and negative covenants, subject to certain exceptions, including