Cablevision 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(75)

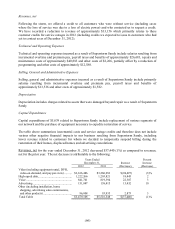

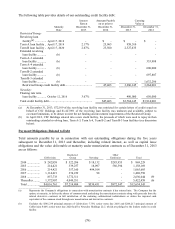

Net cash used in investing activities for the year ended December 31, 2012 was $993,072 compared to

$735,228 for the year ended December 31, 2011. The 2012 investing activities consisted primarily of

$991,586 of capital expenditures ($850,061 of which relates to our Cable segment) and other net cash

payments of $1,486.

Net cash used in investing activities for the year ended December 31, 2011 was $735,228. The 2011

investing activities consisted primarily of capital expenditures of $725,876 ($568,458 of which relate to

our Cable segment), additions to other intangible assets of $10,797, partially offset by other net cash

receipts of $1,445.

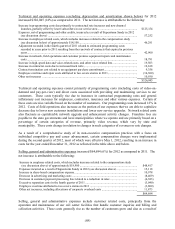

Financing Activities

Net cash used in financing activities amounted to $894,074 for the year ended December 31, 2013

compared to $890,313 for the year ended December 31, 2012. In 2013, the Company's financing

activities consisted primarily of distributions to Cablevision of $501,224, payments to redeem and

repurchase senior notes, including premiums and fees, of $308,673, net repayments of credit facility debt

of $148,991, additions to deferred financings costs of $27,080, principal payments on capital lease

obligations of $13,828 and other cash payments of $1,994, partially offset by cash receipts from net

proceeds from collateralized indebtedness of $61,552, and an excess tax benefit related to share-based

awards of $46,164.

Net cash used in financing activities amounted to $890,313 for the year ended December 31, 2012

compared $441,582 for the year ended December 31, 2011. In 2012, the Company's financing activities

consisted primarily of net repayments of credit facility debt of $519,458, the redemption and repurchase

of senior notes of $504,501, payments on capital leases of $13,729, additions to deferred financings costs

of $5,296, and other net cash payments of $1,588, partially offset by net capital contributions from

Cablevision of $63,191, net effect of excess tax benefit on share-based awards of $61,434 and net

proceeds from collateralized indebtedness and related derivative contracts of $29,634.

Net cash used in financing activities amounted to $441,582 for the year ended December 31, 2011. In

2011, CSC Holding's financing activities consisted primarily of the repurchase of senior notes and

debentures pursuant to a tender offer of $1,227,307, net distributions made to Cablevision of $929,947,

additions to deferred financing costs of $25,186, and other net cash payments of $4,537, partially offset

by proceeds of $1,000,000 from the issuance of senior notes, net proceeds of credit facility debt of

$684,349, net proceeds from collateralized indebtedness of $49,850 and net effect of excess tax benefit on

share-based awards of $11,196.

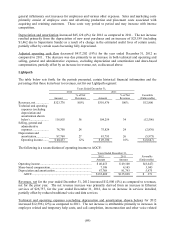

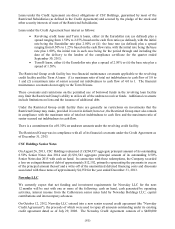

Discontinued Operations - Cablevision Systems Corporation and CSC Holdings, LLC

The net effect of discontinued operations on cash and cash equivalents amounted to a cash inflow of

$838,349, $336,709, and $1,262 for the years ended December 31, 2013, 2012 and 2011, respectively.

Operating Activities

Net cash provided by operating activities of discontinued operations amounted to $199,006 for the year

ended December 31, 2013 compared to $437,280 for the year ended December 31, 2012. The 2013 cash

provided by operating activities resulted from income of $214,225 before depreciation and amortization

(including impairments) and other non-cash items and a $2,087 increase in accounts payable and accrued

liabilities. These increases were partially offset by a decrease in cash of $17,306 resulting from an

increase in current and other assets.

Net cash provided by operating activities of discontinued operations amounted to $437,280 for the year

ended December 31, 2012 compared to $221,661 for the year ended December 31, 2011. The 2012 cash