Cablevision 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-49

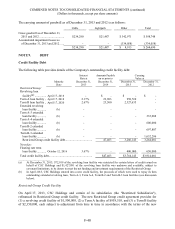

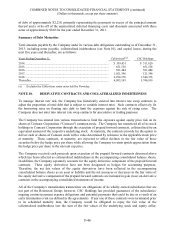

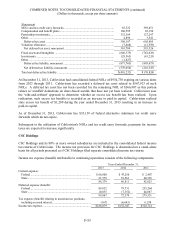

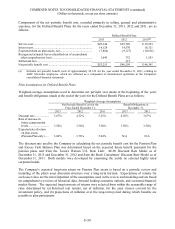

At December 31, 2012:

Level I Level II Level III Total

Assets:

Money market funds ................................. $250,695 $ - $ - $250,695

Investment securities ................................. 122 - - 122

Investment securities pledged as

collateral ................................................ 802,834 - - 802,834

Prepaid forward contracts .......................... - 3,143 - 3,143

Liabilities:

Liabilities under derivative contracts:

Prepaid forward contracts ....................... - 148,263 - 148,263

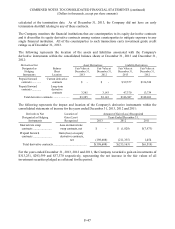

The Company's cash equivalents and restricted cash, investment securities and investment securities

pledged as collateral are classified within Level I of the fair value hierarchy because they are valued using

quoted market prices.

The Company's prepaid forward contracts reflected as derivative contracts and liabilities under derivative

contracts on the Company's balance sheets are valued using market-based inputs to valuation models.

These valuation models require a variety of inputs, including contractual terms, market prices, yield

curves, and measures of volatility. When appropriate, valuations are adjusted for various factors such as

liquidity, bid/offer spreads and credit risk considerations. Such adjustments are generally based on

available market evidence. Since model inputs can generally be verified and do not involve significant

management judgment, the Company has concluded that these instruments should be classified within

Level II of the fair value hierarchy.

The Company considers the impact of credit risk when measuring the fair value of its derivative asset

and/or liability positions, as applicable.

In addition, see Note 4 for a discussion of impairment charges related to nonfinancial assets not measured

at fair value on a recurring basis.

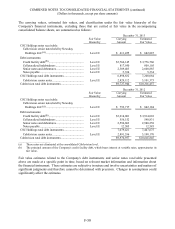

Fair Value of Financial Instruments

The following methods and assumptions were used to estimate fair value of each class of financial

instruments for which it is practicable to estimate:

Credit Facility Debt, Collateralized Indebtedness, Senior Notes and Debentures and Notes Payable

The fair values of each of the Company's debt instruments are based on quoted market prices for the same

or similar issues or on the current rates offered to the Company for instruments of the same remaining

maturities.