Cablevision 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-53

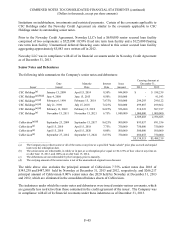

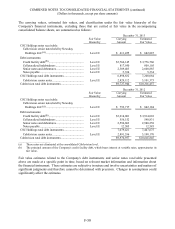

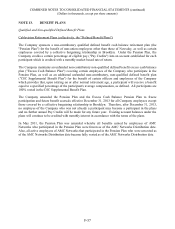

Noncurrent

NOLs and tax credit carry forwards .................................................................

65,322

389,851

Compensation and benefit plans ......................................................................

106,595

85,196

Partnership investments...................................................................................

132,384

127,297

Other ..............................................................................................................

4,896

3,541

Deferred tax asset ........................................................................................

309,197

605,885

Valuation allowance........................................................................................

(7,488)

(12,559)

Net deferred tax asset, noncurrent ................................................................

301,709

593,326

Fixed assets and intangibles ............................................................................

(840,375)

(762,438)

Investments.....................................................................................................

(29,563)

(41,235)

Other ..............................................................................................................

(1,827)

-

Deferred tax liability, noncurrent .................................................................

(871,765)

(803,673)

Net deferred tax liability, noncurrent ............................................................

(570,056)

(210,347)

Total net deferred tax liability .........................................................................

$(410,232)

$ (70,824)

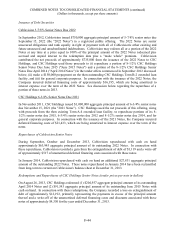

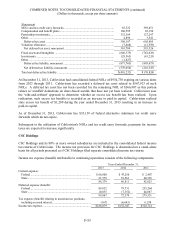

At December 31, 2013, Cablevision had consolidated federal NOLs of $934,730 expiring on various dates

from 2023 through 2031. Cablevision has recorded a deferred tax asset related to $567,923 of such

NOLs. A deferred tax asset has not been recorded for the remaining NOL of $366,807 as this portion

relates to 'windfall' deductions on share-based awards that have not yet been realized. Cablevision uses

the 'with-and-without' approach to determine whether an excess tax benefit has been realized. Upon

realization, such excess tax benefits is recorded as an increase to paid-in capital. Cablevision realized

state excess tax benefit of $1,280 during the year ended December 31, 2013 resulting in an increase to

paid-in capital.

As of December 31, 2013, Cablevision has $35,138 of federal alternative minimum tax credit carry

forwards which do not expire.

Subsequent to the utilization of Cablevision's NOLs and tax credit carry forwards, payments for income

taxes are expected to increase significantly.

CSC Holdings

CSC Holdings and its 80% or more owned subsidiaries are included in the consolidated federal income

tax returns of Cablevision. The income tax provision for CSC Holdings is determined on a stand-alone

basis for all periods presented as if CSC Holdings filed separate consolidated income tax returns.

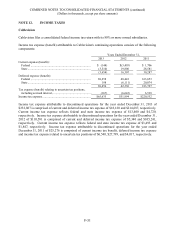

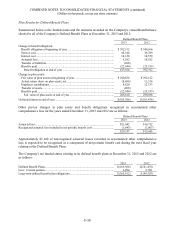

Income tax expense (benefit) attributable to continuing operations consists of the following components:

Years Ended December 31,

2013

2012

2011

Current expense:

Federal ............................................................................. $ 66,800

$ 47,250

$ 2,487

State ................................................................................. 21,579

39,561

40,338

88,379

86,811

42,825

Deferred expense (benefit):

Federal ............................................................................. 89,832

79,731

235,264

State ................................................................................. 10,035

(7,352)

44,087

99,867

72,379

279,351

Tax expense (benefit) relating to uncertain tax positions,

including accrued interest .................................................. (167)

(6,643)

6,538

Income tax expense .............................................................. $188,079

$152,547

$328,714