Cablevision 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-33

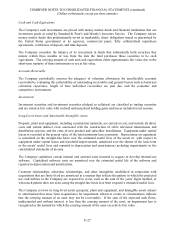

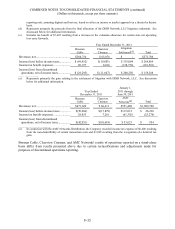

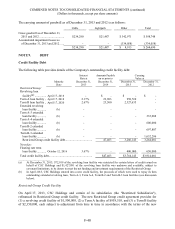

NOTE 4. RESTRUCTURING AND IMPAIRMENT CHARGES

Restructuring

In the fourth quarter of 2013, as a result of a strategic evaluation of the Company's operations, the

Company recorded restructuring charges of $22,879 which included expenses of $11,283 associated

primarily with the elimination of 234 positions in the Cable segment, $10,038 associated primarily with

the elimination of 191 positions in the Other segment, and $1,558 associated primarily with the

elimination of 16 positions in the Lightpath segment. Additionally, the Company expensed $1,205 in

connection with an early lease termination in the Other segment. The following table summarizes the

accrued restructuring liability related to the 2013 restructuring plan for continuing operations:

Cable

Segment

Lightpath

Segment

Other

Segment

Total

Restructuring charges relating to

severance, net ........................................

.

$11,283 $1,558

$10,038

$22,879

Restructuring charges relating to an early

lease termination ....................................

.

- -

1,205

1,205

Total restructuring expense ........................

.

11,283 1,558

11,243

24,084

Payments and other ................................

.

(8,556) (628)

(158)

(9,342)

Accrual balance at December 31, 2013 ......

.

$ 2,727 $ 930

$ 11,085

$14,742

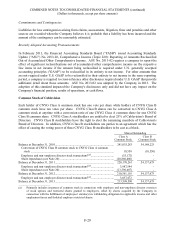

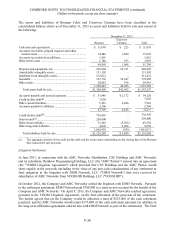

In addition to the charges included in the table above, the Company recorded net restructuring charges

(credits) of $(534), $(770), and $6,311, in 2013, 2012 and 2011, respectively. The 2013 and 2012

restructuring credits primarily related to changes to the Company's previous estimates recorded in

connection with the Company's prior restructuring plans. The $6,311 restructuring expense recognized in

2011 related to the elimination of 97 positions, primarily within the Newsday business which was all paid

as of December 31, 2013.

Impairment Charges

Goodwill and indefinite-lived intangible assets are tested annually for impairment during the first quarter

of each year or earlier upon the occurrence of certain events or substantive changes in circumstances. As

a result of the continuing deterioration of values in the newspaper industry and the greater than

anticipated economic downturn and its current and anticipated impact on Newsday's advertising business,

the Company determined that a triggering event had occurred at the Newsday reporting unit and the

Company tested Newsday's indefinite-lived intangibles and goodwill for impairment at December 31,

2013, 2012 and 2011 (the "interim testing dates").

The estimated fair values of the Newsday business indefinite-lived intangibles, which relate primarily to

the trademarks associated with its mastheads, were based on discounted future cash flows calculated

utilizing the relief-from-royalty method. Changes in such estimates or the application of alternative

assumptions could produce significantly different results.

The Company's impairment analysis as of December 31, 2013, 2012 and 2011 resulted in pre-tax

impairment charges of $25,100, $13,000 and $11,000, respectively, related to the excess of the carrying

value over the estimated fair value of the Company's trademarks. Additionally, in 2013 the Company

recorded an impairment charge of $12,358 relating to the excess of the carrying value over the estimated

fair value of the Company's advertiser relationships. The decrease in fair value, which was determined

based on discounted cash flows, resulted primarily from the decline in projected cash flows related to

these assets. These pre-tax impairment charges are included in depreciation and amortization (including