Cablevision 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

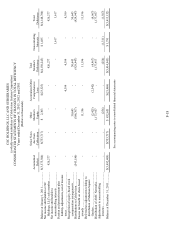

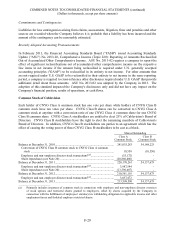

CSC HOLDINGS, LLC AND SUBSIDIARIES

(a wholly-owned subsidiary of Cablevision Systems Corporation)

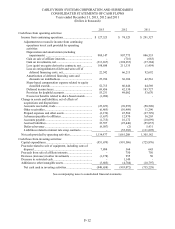

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

Years ended December 31, 2013, 2012 and 2011

(Dollars in thousands)

F-22

2013

2012

2011

Cash flows from financing activities:

Proceeds from credit facility debt, net of discount ................ 3,296,760

-

1,265,000

Repayment of credit facility debt ......................................... (3,445,751)

(519,458)

(580,651)

Proceeds from issuance of senior notes ................................ -

-

1,000,000

Redemption and repurchase of senior notes, including

premiums and fees ........................................................... (308,673)

(504,501)

(1,227,307)

Repayment of notes payable ................................................ (570)

-

-

Proceeds from collateralized indebtedness ........................... 569,561

248,388

307,763

Repayment of collateralized indebtedness and related

derivative contracts .......................................................... (508,009)

(218,754)

(257,913)

Principal payments on capital lease obligation s .................... (13,828)

(13,729)

(3,226)

Capital contributions from Cablevision ................................ -

735,000

-

Distributions to Cablevision ................................................ (501,224)

(671,809)

(929,947)

Excess tax benefit related to share-based awards .................. 46,164

61,434

11,196

Additions to deferred financing costs ................................... (27,080)

(5,296)

(25,186)

Distributions to noncontrolling interests, net ........................ (1,424)

(1,588)

(1,311)

Net cash used in financing activities ................................. (894,074)

(890,313)

(441,582)

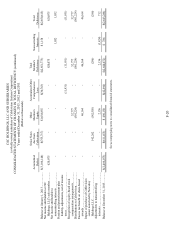

Net increase (decrease) in cash and cash equivalents from

continuing operations .......................................................... (444,035)

(668,376)

346,360

Cash flows of discontinued operations:

Net cash provided by operating activities ............................. 199,006

437,280

221,661

Net cash provided by (used in) investing activities .............. 646,185

(83,671)

(100,771)

Net cash used in financing activities .................................... (38,735)

(7,650)

(5,233)

Effect of change in cash related to discontinued operations .. 31,893

(9,250)

(114,395)

Net increase in cash and cash equivalents from

discontinued operations ................................................ 838,349

336,709

1,262

Cash and cash equivalents at beginning of year ....................... 256,744

588,411

240,789

Cash and cash equivalents at end of year ................................. $ 651,058

$ 256,744

$ 588,411

See accompanying notes to consolidated financial statements.