Cablevision 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

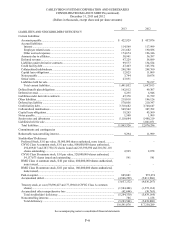

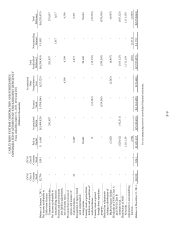

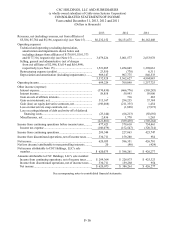

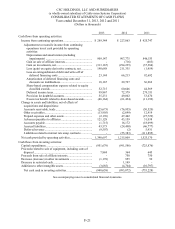

CABLEVISION SYSTEMS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

Years ended December 31, 2013, 2012 and 2011

(Dollars in thousands)

F-13

2013 2012 2011

Cash flows from financing activities:

Proceeds from credit facility debt, net of discount ...............

.

3,296,760 - 1,265,000

Repayment of credit facility debt ........................................

.

(3,445,751) (519,458) (580,651)

Proceeds from issuance of senior notes ...............................

.

- 750,000 1,000,000

Redemption and repurchase of senior notes, including

premiums and fees ..........................................................

.

(371,498) (531,326) (1,227,307)

Repayment of notes payable ...............................................

.

(570) - -

Proceeds from collateralized indebtedness ..........................

.

569,561 248,388 307,763

Repayment of collateralized indebtedness and related

derivative contracts .........................................................

.

(508,009) (218,754) (257,913)

Dividend distributions to common stockholders ..................

.

(159,709) (163,872) (162,032)

Proceeds from stock option exercises .................................

.

18,120 18,722 6,471

Tax withholding associated with shares issued for equity-

based compensation ........................................................

.

(644) - -

Principal payments on capital lease obligation s ...................

.

(13,828) (13,729) (3,226)

Deemed repurchases of restricted stock ..............................

.

(12,262) (19,831) (35,555)

Purchase of shares of CNYG Class A common stock,

pursuant to a share repurchase program, held as

treasury shares ................................................................

.

- (188,600) (555,831)

Excess tax benefit related to share-based awards .................

.

1,280 - -

Additions to deferred financing costs ..................................

.

(27,080) (21,491) (25,186)

Distributions to noncontrolling interests, net .......................

.

(1,424) (1,588) (1,311)

Net cash used in financing activities ................................

.

(655,054) (661,539) (269,778)

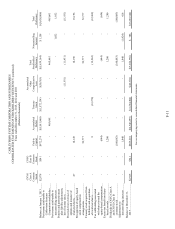

Net increase (decrease) in cash and cash equivalents from

continuing operations .........................................................

.

(468,735) (593,403) 300,176

Cash flows of discontinued operations:

Net cash provided by operating activities ............................

.

199,006 437,280 221,661

Net cash provided by (used in) investing activities ..............

.

646,185 (83,671) (100,771)

Net cash used in financing activities ...................................

.

(38,735) (7,650) (5,233)

Effect of change in cash related to discontinued

operation s .......................................................................

.

31,893 (9,250) (114,395)

Net increase in cash and cash equivalents from

discontinued operations ...............................................

.

838,349 336,709 1,262

Cash and cash equivalents at beginning of year ......................

.

332,610 589,304 287,866

Cash and cash equivalents at end of year ................................

.

$ 702,224 $ 332,610 $ 589,304

See accompanying notes to consolidated financial statements.