Cablevision 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

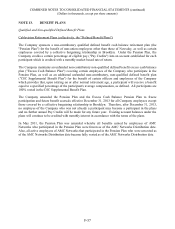

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-59

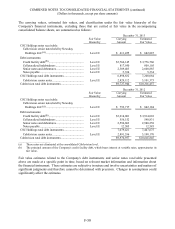

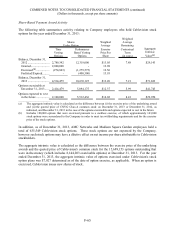

Components of the net periodic benefit cost, recorded primarily in selling, general and administrative

expenses, for the Defined Benefit Plans for the years ended December 31, 2013, 2012 and 2011, are as

follows:

Defined Benefit Plans

2013

2012

2011(a)

Service cost ...........................................................................

.

$45,346

$39,789

$ 39,253

Interest cost ...........................................................................

.

14,128

14,570

16,321

Expected return on plan assets, net .........................................

.

(7,866)

(9,127)

(10,816)

Recognized actuarial loss (reclassified out of accumulated

other comprehensive loss) ...................................................

.

1,645

752

1,583

Settlement loss ......................................................................

.

-

315

-

Net periodic benefit cost ........................................................

.

$53,253

$46,299

$ 46,341

___________________________

(a) Includes net periodic benefit costs of approximately $2,332 for the year ended December 31, 2011, relating to

AMC Networks employees, which are reflected as a component of discontinued operations in the Company's

consolidated financial statements.

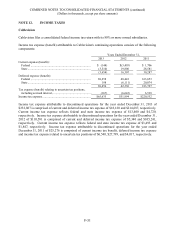

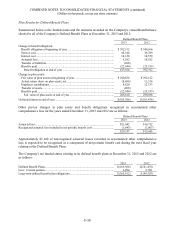

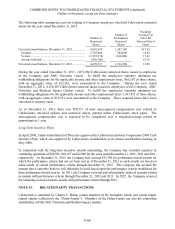

Plan Assumptions for Defined Benefit Plans

Weighted-average assumptions used to determine net periodic cost (made at the beginning of the year)

and benefit obligations (made at the end of the year) for the Defined Benefit Plans are as follows:

Weighted-Average Assumptions

Net Periodic Benefit Cost for the

Years Ended December 31,

Benefit Obligations at

December 31,

2013 2012 2011 2013 2012

Discount rate .................

.

3.67% 4.32% 5.25% 4.56% 3.67%

Rate of increase in

future compensation

levels .........................

.

3.50% 3.50% 3.50% 3.50% 3.50%

Expected rate of return

on plan assets

(Pension Plan only) ....

.

3.60% 3.76% 5.04% N/A N/A

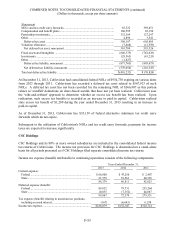

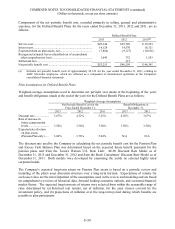

The discount rate used by the Company in calculating the net periodic benefit cost for the Pension Plan

and Excess Cash Balance Plan was determined based on the expected future benefit payments for the

pension plans and from the Towers Watson U.S. Rate Link: 40-90 Discount Rate Model as of

December 31, 2013 and December 31, 2012 and from the Buck Consultants' Discount Rate Model as of

December 31, 2011. Both models were developed by examining the yields on selected highly rated

corporate bonds.

The Company's expected long-term return on Pension Plan assets is based on a periodic review and

modeling of the plan's asset allocation structure over a long-term horizon. Expectations of returns for

each asset class are the most important of the assumptions used in the review and modeling and are based

on comprehensive reviews of historical data, forward looking economic outlook, and economic/financial

market theory. The expected long-term rate of returns were selected from within the reasonable range of

rates determined by (a) historical real returns, net of inflation, for the asset classes covered by the

investment policy, and (b) projections of inflation over the long-term period during which benefits are

payable to plan participants.