Cablevision 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(44)

Critical Accounting Policies

In preparing its financial statements, the Company is required to make certain estimates, judgments and

assumptions that it believes are reasonable based upon the information available. These estimates and

assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the periods presented. The significant accounting

policies, which we believe are the most critical to aid in fully understanding and evaluating our reported

financial results, include the following:

Impairment of Long-Lived and Indefinite-Lived Assets:

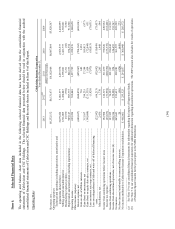

The Company's long-lived and indefinite-lived assets at December 31, 2013 include goodwill of

$264,690, other intangible assets of $789,250 ($739,298 of which are indefinite-lived intangible assets),

and $2,978,353 of property, plant and equipment. Such assets accounted for approximately 61% of the

Company's consolidated total assets. Goodwill and identifiable indefinite-lived intangible assets, which

represent primarily the Company's cable television franchises and various trademarks, are tested annually

for impairment during the first quarter ("annual impairment test date") and upon the occurrence of certain

events or substantive changes in circumstances.

We assess qualitative factors for certain of our reporting units that carry goodwill. Among other relevant

events and circumstances that affect the fair value of these reporting units, we assess individual factors

such as:

x macroeconomic conditions;

x industry and market conditions;

x overall financial performance of the reporting unit;

x changes in management, strategy or customers; and

x relevant reporting unit specific events such as a change in the carrying amount of net assets, a

more-likely-than-not expectation of selling or disposing all, or a portion, of a reporting unit.

The Company assesses these qualitative factors to determine whether it is necessary to perform the two-

step quantitative goodwill impairment test. This quantitative test is required only if the Company

concludes that it is more likely than not that a reporting unit's fair value is less than its carrying amount.

When the qualitative assessment is not used, or if the qualitative assessment is not conclusive, the

Company is required to determine goodwill impairment using a two-step process. The first step of the

goodwill impairment test is used to identify potential impairment by comparing the fair value of a

reporting unit with its carrying amount, including goodwill utilizing an enterprise-value based premise

approach. If the carrying amount of a reporting unit exceeds its fair value, the second step of the goodwill

impairment test is performed to measure the amount of impairment loss, if any. The second step of the

goodwill impairment test compares the implied fair value of the reporting unit's goodwill with the

carrying amount of that goodwill. If the carrying amount of the reporting unit's goodwill exceeds the

implied fair value of that goodwill, an impairment loss is recognized in an amount equal to that excess.

The implied fair value of goodwill is determined in the same manner as the amount of goodwill that

would be recognized in a business combination. For the purpose of evaluating goodwill impairment at

the annual impairment test date, the Company had two reporting units containing approximately 97% of

the Company's goodwill balance of $264,690. These reporting units are Cable ($234,290) and Lightpath

($21,487).