Cablevision 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(49)

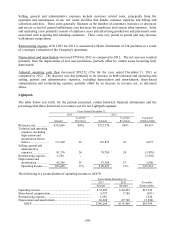

Non-GAAP Financial Measures

We define adjusted operating cash flow ("AOCF"), which is a non-GAAP financial measure, as operating

income (loss) before depreciation and amortization (including impairments), excluding share-based

compensation expense or benefit and restructuring expense or credits. Because it is based upon operating

income (loss), AOCF also excludes interest expense (including cash interest expense) and other non-

operating income and expense items. We believe that the exclusion of share-based compensation expense

allows investors to better track the performance of the various operating units of our business without

regard to expense associated with awards that are not expected to be made in cash, in the case of restricted

shares, restricted stock units and stock options, and the distortive effects of fluctuating stock prices in the

case of stock appreciation rights.

We present AOCF as a measure of our ability to service our debt and make continuing investments,

including in our capital infrastructure. We believe AOCF is an appropriate measure for evaluating the

operating performance of our business segments and the Company on a consolidated basis. AOCF and

similar measures with similar titles are common performance measures used by investors, analysts and

peers to compare performance in our industry. Internally, we use net revenues and AOCF measures as

the most important indicators of our business performance, and evaluate management's effectiveness with

specific reference to these indicators. AOCF should be viewed as a supplement to and not a substitute for

operating income (loss), net income (loss), cash flows from operating activities, and other measures of

performance and/or liquidity presented in accordance with U.S. generally accepted accounting principles

("GAAP"). Since AOCF is not a measure of performance calculated in accordance with GAAP, this

measure may not be comparable to similar measures with similar titles used by other companies. Each

presentation of AOCF in this Annual Report on Form 10-K includes a reconciliation of AOCF to

operating income (loss).