Cablevision 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

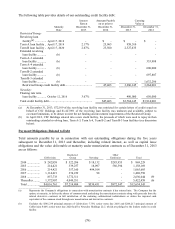

(81)

Loans under the Credit Agreement are direct obligations of CSC Holdings, guaranteed by most of the

Restricted Subsidiaries (as defined in the Credit Agreement) and secured by the pledge of the stock and

other security interests of most of the Restricted Subsidiaries.

Loans under the Credit Agreement bear interest as follows:

x Revolving credit loans and Term A loans, either (i) the Eurodollar rate (as defined) plus a

spread ranging from 1.50% to 2.25% based on the cash flow ratio (as defined), with the initial

rate being the Eurodollar rate plus 2.00% or (ii) the base rate (as defined) plus a spread

ranging from 0.50% to 1.25% based on the cash flow ratio, with the initial rate being the base

rate plus 1.00%, the initial rate in each case being for the period through and including the

date of the delivery to the lenders of the compliance certificate for the quarter ended

September 30, 2013;

x Term B loans, either (i) the Eurodollar rate plus a spread of 2.50% or (ii) the base rate plus a

spread of 1.50%.

The Restricted Group credit facility has two financial maintenance covenants applicable to the revolving

credit facility and the Term A loans: (1) a maximum ratio of total net indebtedness to cash flow of 5.0 to

1 and (2) a maximum ratio of senior secured net indebtedness to cash flow of 4.0 to 1. The financial

maintenance covenants do not apply to the Term B loans.

These covenants and restrictions on the permitted use of borrowed funds in the revolving loan facility

may limit the Restricted Group's ability to utilize all of the undrawn revolver funds. Additional covenants

include limitations on liens and the issuance of additional debt.

Under the Restricted Group credit facility there are generally no restrictions on investments that the

Restricted Group may make, provided it is not in default; however, the Restricted Group must also remain

in compliance with the maximum ratio of total net indebtedness to cash flow and the maximum ratio of

senior secured net indebtedness to cash flow.

There is a commitment fee of 0.30% on undrawn amounts under the revolving credit facility.

The Restricted Group was in compliance with all of its financial covenants under the Credit Agreement as

of December 31, 2013.

CSC Holdings Senior Notes

On August 26, 2013, CSC Holdings redeemed (1) $204,937 aggregate principal amount of its outstanding

8.50% Senior Notes due 2014 and (2) $91,543 aggregate principal amount of its outstanding 8.50%

Senior Notes due 2015 with cash on hand. In connection with these redemptions, the Company recorded

a loss on extinguishment of debt of approximately $12,192, primarily representing the payments in excess

of the principal amount thereof and a write-off of the unamortized deferred financing costs and discounts

associated with these notes of approximately $4,350 for the year ended December 31, 2013.

Newsday LLC

We currently expect that net funding and investment requirements for Newsday LLC for the next

12 months will be met with one or more of the following: cash on hand, cash generated by operating

activities, interest income from the Cablevision senior notes held by Newsday Holdings LLC, capital

contributions and intercompany advances.

On October 12, 2012, Newsday LLC entered into a new senior secured credit agreement (the "Newsday

Credit Agreement"), the proceeds of which were used to repay all amounts outstanding under its existing

credit agreement dated as of July 29, 2008. The Newsday Credit Agreement consists of a $480,000