Cablevision 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(42)

Accordingly, Verizon may increase the number of customers in our service area to whom it is able to sell

video in the future. AT&T (which recently entered into an agreement to sell its Connecticut operation to

Frontier Communications) offers video service in competition with us in most of our Connecticut service

area. Verizon and AT&T also market DBS services in our service area. This competition with Verizon

and AT&T negatively impacts our video revenue in these areas and will continue to do so in the future.

Each of these companies has significantly greater financial resources than we do.

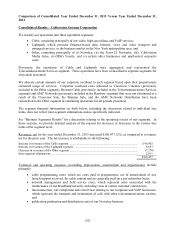

Our high-speed data services business, which accounted for 22% of our consolidated revenues, net of

inter-segment eliminations, for the year ended December 31, 2013, faces intense competition from other

providers of high-speed Internet access, including Verizon and AT&T. Verizon offers high speed data

services to customers in our footprint in areas where it is currently able to sell fiber-based video service as

well as areas where it is not currently able to sell fiber-based video service. Additionally, Verizon has

also built its fiber network in areas where we believe it is not currently able to sell its high-speed data

services. Accordingly, Verizon may increase the number of customers in our service area to whom it is

able to sell high-speed data services in the future. Due to our high penetration (55.2% of serviceable

passings at December 31, 2013) and the impact of intense competition, our ability to maintain or increase

our existing customers and revenue in the future will continue to be negatively impacted.

Our VoIP offering, which accounted for 13% of our consolidated revenues, net of inter-segment

eliminations, for the year ended December 31, 2013, faces intense competition from other providers of

voice services, including carriers such as Verizon and AT&T. We compete primarily on the basis of

pricing, where unlimited United States and Canada (including Puerto Rico and the U.S. Virgin Islands)

long distance, regional and local calling, together with certain features for which the incumbent providers

charge extra, are offered at one low price. Verizon offers VoIP services to customers in our footprint in

areas where it is currently able to sell fiber-based video service as well as areas where it is not currently

able to sell fiber-based video service. Additionally, Verizon has also built its fiber network in areas

where we believe it is not currently able to sell their VoIP services. Accordingly, Verizon may increase

the number of customers in our service area to whom it is able to sell VoIP services in the future. Due to

the high penetration (45.1% of serviceable passings at December 31, 2013) and the impact of intense

competition, our ability to maintain or increase our existing customers and revenue in the future will

continue to be negatively impacted.

Our programming costs, which are the most significant component of our Cable segment's operating

expenses, have increased and are expected to continue to increase primarily as a result of contractual rate

increases and new channel launches. Additionally, as a result of various initiatives to improve our

services, our level of capital expenditures and other operating expenses have also increased. See

"Business Segments Results - Cable" below for a further discussion of revenues and operating expenses

and "Liquidity and Capital Resources - Capital Expenditures" for additional information regarding our

capital expenditures.

Lightpath

Lightpath accounted for 5% of our consolidated revenues, net of inter-segment eliminations, for the year

ended December 31, 2013. Lightpath operates in a highly competitive business telecommunications

market and competes against the very largest telecommunications companies - incumbent local exchange

carriers such as Verizon and AT&T, other competitive local exchange companies, and long distance

companies. To the extent our competitors reduce their prices, future success of our Lightpath business

may be negatively impacted.