Cablevision 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(50)

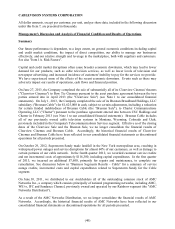

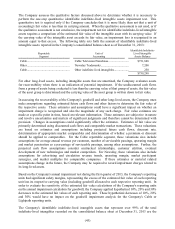

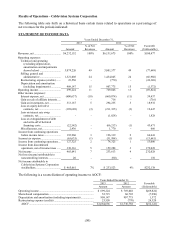

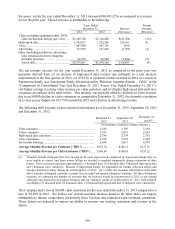

Results of Operations - Cablevision Systems Corporation

The following table sets forth on a historical basis certain items related to operations as a percentage of

net revenues for the periods indicated:

STATEMENT OF INCOME DATA

Years Ended December 31,

2013 2012

% of Net

% of Net Favorable

Amount Revenues

Amount

Revenues (Unfavorable)

Revenues, net ...................................... $6,232,152 100%

$6,131,675

100% $100,477

Operating expenses:

Technical and operating

(excluding depreciation,

amortization and impairments

shown below) .............................. 3,079,226 49

3,001,577

49 (77,649)

Selling, general and

administrative .............................. 1,521,005 24

1,454,045

24 (66,960)

Restructuring expense (credits) ....... 23,550 -

(770)

- (24,320)

Depreciation and amortization

(including impairments) .............. 909,147 15

907,775

15 (1,372)

Operating income ................................ 699,224 11

769,048

13 (69,824)

Other income (expense):

Interest expense, net ........................ (600,637) (10)

(660,074)

(11) 59,437

Gain on sale of affiliate interests ..... - -

716

- (716)

Gain on investments, net ................. 313,167 5

294,235

5 18,932

Loss on equity derivative

contracts, net................................ (198,688) (3)

(211,335)

(3) 12,647

Loss on interest rate swap

contracts, net................................ - -

(1,828)

- 1,828

Loss on extinguishment of debt

and write-off of deferred

financing costs ............................. (22,542) -

(66,213)

(1) 43,671

Miscellaneous, net ........................... 2,436 -

1,770

- 666

Income from continuing operations

before income taxes ........................ 192,960 3

126,319

2 66,641

Income tax expense ............................ (65,635) (1)

(51,994)

(1) (13,641)

Income from continuing operations .... 127,325 2

74,325

1 53,000

Income from discontinued

operations, net of income taxes ...... 338,316 5

159,288

3 179,028

Net income ......................................... 465,641 7

233,613

4 232,028

Net loss (income) attributable to

noncontrolling interests .................. 20 -

(90)

- 110

Net income attributable to

Cablevision Systems Corporation

stockholders .................................... $ 465,661 7%

$ 233,523

4% $232,138

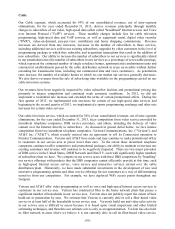

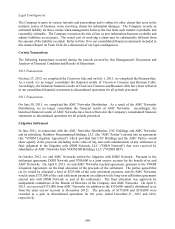

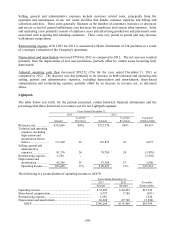

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2013 2012 Favorable

Amount Amount (Unfavorable)

Operating income ............................................................................

.

$ 699,224 $ 769,048 $(69,824)

Share-based compensation ..............................................................

.

52,715 60,705 (7,990)

Depreciation and amortization (including impairments) .................

.

909,147 907,775 1,372

Restructuring expense (credits) .......................................................

.

23,550 (770) 24,320

AOCF ..........................................................................................

.

$1,684,636 $1,736,758 $(52,122)