Cablevision 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

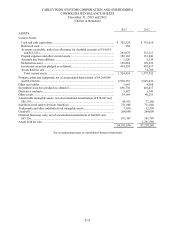

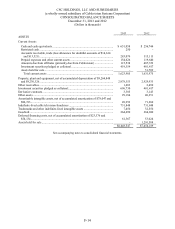

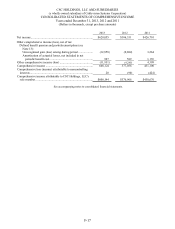

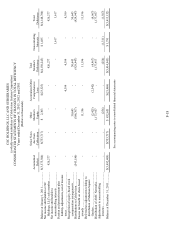

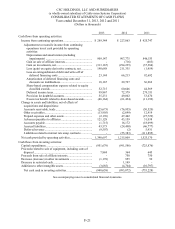

CSC HOLDINGS, LLC AND SUBSIDIARIES

(a wholly-owned subsidiary of Cablevision Systems Corporation)

CONSOLIDATED BALANCE SHEETS

December 31, 2013 and 2012

(Dollars in thousands)

F-14

2013

2012

ASSETS

Current Assets:

Cash and cash equivalents ..............................................................................

$ 651,058

$ 256,744

Restricted cash ...............................................................................................

250

-

Accounts receivable, trade (less allowance for doubtful accounts of $14,614

and $13,521) ...............................................................................................

283,079

315,113

Prepaid expenses and other current assets .......................................................

154,626

119,640

Amounts due from affiliates (primarily due from Cablevision) ........................

115,538

487,352

Investment securities pledged as collateral ......................................................

419,354

401,417

Assets held for sale .........................................................................................

-

51,709

Total current assets .....................................................................................

1,623,905

1,631,975

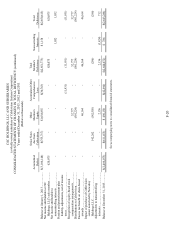

Property, plant and equipment, net of accumulated depreciation of $9,264,848

and $9,230,326 ...............................................................................................

2,978,353

2,929,933

Other receivables ...............................................................................................

1,683

2,490

Investment securities pledged as collateral..........................................................

696,730

401,417

Derivative contracts ...........................................................................................

3,385

3,143

Other assets .......................................................................................................

29,184

40,251

Amortizable intangible assets, net of accumulated amortization of $78,047 and

$86,193 ..........................................................................................................

49,952

71,260

Indefinite-lived cable television franchises .........................................................

731,848

731,848

Trademarks and other indefinite-lived intangible assets ......................................

7,450

32,550

Goodwill ...........................................................................................................

264,690

264,690

Deferred financing costs, net of accumulated amortization of $23,376 and

$54,134 ..........................................................................................................

61,367

53,024

Assets held for sale ............................................................................................

-

1,291,588

$6,448,547

$7,454,169

See accompanying notes to consolidated financial statements.