Cablevision 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-32

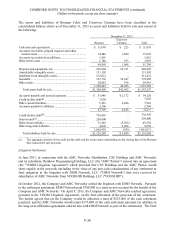

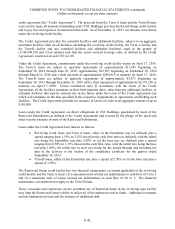

Concentrations of Credit Risk

Financial instruments that may potentially subject the Company to a concentration of credit risk consist

primarily of cash and cash equivalents and trade account receivables. The Company monitors the

financial institutions and money market funds where it invests its cash and cash equivalents with

diversification among counterparties to mitigate exposure to any single financial institution. The

Company's emphasis is primarily on safety of principal and liquidity and secondarily on maximizing the

yield on its investments. Management believes that no significant concentration of credit risk exists with

respect to its cash and cash equivalents balances because of its assessment of the creditworthiness and

financial viability of the respective financial institutions.

The Company did not have a single customer that represented 10% or more of its consolidated net

revenues for the years ended December 31, 2013, 2012 and 2011, or 10% or more of its consolidated net

trade receivables at December 31, 2013 and 2012.

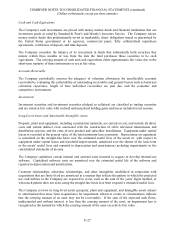

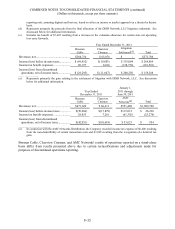

NOTE 3. SUPPLEMENTAL CASH FLOW INFORMATION

During 2013, 2012 and 2011, the Company's non-cash investing and financing activities and other

supplemental data were as follows:

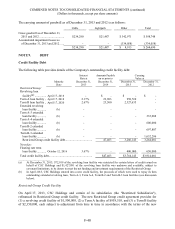

Years Ended December 31,

2013 2012 2011

Non-Cash Investing and Financing Activities of

Cablevision and CSC Holdings:

Continuing Operations:

Property and equipment accrued but unpaid ......................... $65,391 $93,760 $62,025

Capital lease obligations...................................................... 11,499 27,535 14,877

Reduction in capital lease obligation as a result of not

exercising a bargain purchase option ................................ 22,950 - -

Intangible asset obligations ................................................. 2,498 1,435 8,501

Notes payable to vendors .................................................... 1,202 - 29,796

Satisfaction and discharge of debt with AMC Networks

debt ................................................................................. - - 1,250,000

Distribution of AMC Networks (Cablevision) ...................... - - 1,111,159

Distribution of AMC Networks (CSC Holdings) .................. - - 1,177,957

Distribution of Cablevision senior notes by CSC Holdings

to Cablevision (CSC Holdings) ........................................ 142,262 - -

Non-Cash Investing Activity of Cablevision:

Dividends payable on unvested restricted share awards ........ 3,466 3,119 4,150

Supplemental Data:

Continuing Operations - Cablevision:

Cash interest paid ................................................................ 580,906 646,346 651,558

Income taxes paid, net ........................................................ 16,470 13,418 29,351

Continuing Operations - CSC Holdings:

Cash interest paid ................................................................ 362,365 469,502 473,639

Income taxes paid, net ........................................................ 16,470 13,437 29,351

Discontinued operations - Cablevision and CSC Holdings:

Cash interest paid ................................................................ 26,606 61,927 101,557

Income taxes paid, net ........................................................ - - 5,573