Blackberry 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

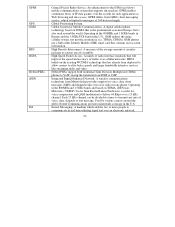

Audit Fees

The aggregate fees billed by Ernst & Young LLP (EY) chartered accountants, the Company’s independent external auditor, for the

fiscal years ended March 3, 2012 and February 26, 2011, respectively, for professional services rendered by EY for the audit of the

Company’s annual financial statements or services that are normally provided by EY in connection with statutory and regulatory

filings or engagements for such fiscal years were $3,331,000 and $2,811,000 respectively.

Audit-Related Fees

The aggregate fees billed by EY for the fiscal years ended March 3, 2012 and February 26, 2011, respectively, for assurance and

related services rendered by EY that are reasonably related to the performance of the audit review of the Company’s financial

statements and are not reported above as audit fees were $195,000 and $65,000.

Tax Fees

The aggregate fees billed by EY for the fiscal years ended March 3, 2012 and February 26, 2011, respectively, for professional

services rendered by EY for tax compliance, tax advice, tax planning and other services were $Nil and $6,700 respectively. Tax

services provided included international tax compliance engagements.

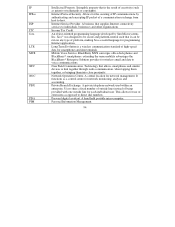

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

To the Company’s knowledge, there were no directors or executive officers or any associate or affiliate of a director or executive

officer with a material interest in any transaction within the three most recently completed financial years or during the current

financial year that has materially affected or is reasonably expected to materially affect the Company.

TRANSFER AGENTS AND REGISTRARS

The Company’s transfer agent and registrar in Canada is Computershare Investor Services Inc. of Canada, 100 University Ave., 9

Fl., Toronto, Ontario M5J 2Y1. The co-transfer agent and registrar for the common shares in the United States is Computershare

Trust Company, Inc. at its offices in Denver, Colorado.

MATERIAL CONTRACTS

Other than as noted below, the Company has not entered into any material contracts, on or after January 1, 2002, that are required to

be filed pursuant to NI 51-102 of the Canadian Securities Administrators. The Company has entered into a licensing and settlement

agreement with NTP, Inc. (the “Settlement and Licensing Agreements”) both of which can be found under the Company’s profile on

www.sedar.com. The Settlement and Licensing Agreements are summarized in the Company’s material change report filed on

SEDAR on March 10, 2006, which is incorporated by reference in the AIF.

89

th