Blackberry 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

As part of the Company’s continuous effort to streamline its operations and increase efficiency, the Company has also commenced

the CORE program. The CORE program is a Company-wide initiative with the objective of improving the Company’s operations.

The program includes, among other things, a review of the Company’s research and development process to maximize the

Company’s return on investment, the implementation of stock keeping units (“SKUs”) rationalization, an evaluation of the product

development cycle to improve yield, warranty return rates and reduce manufacturing costs, an assessment of the Company’s sales and

marketing initiatives to maximize sales efforts and effectively leverage its marketing windows, and a comprehensive review of RIM’s

organizational structure to clearly define accountabilities for all key business, business processes and to eliminate fragmentation and

inefficiencies. The Company is currently targeting the CORE program to drive approximately $1.0 billion in savings by the end of

fiscal 2013 based on current run rates and the Company expects initial savings to be driven primarily by optimizing the cost position

of the Company’s products and services, and improved overall resource effectiveness and organizational efficiency.

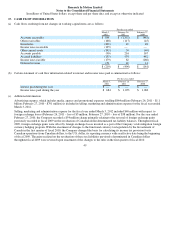

Non-GAAP Financial Measures

As noted above, the Consolidated Financial Statements have been prepared in accordance with U.S. GAAP, and information

contained in this MD&A is presented on that basis. On March 29, 2012, the Company announced financial results for fiscal 2012,

which included certain non-GAAP financial measures, including adjusted revenue, adjusted gross margin, adjusted gross margin

percentage, adjusted net income and adjusted diluted earnings per share that exclude the impact of the pre-tax charges in fiscal 2012

related to the PlayBook Inventory Provision, the Q4 BlackBerry 7 Inventory Provision, the service interruption that occurred in the

third quarter of fiscal 2012 (the “Q3 Service Interruption”) which resulted in the loss of service revenue and the payment of service

credits of approximately $54 million, approximately $40 million after tax, the Cost Optimization Program, and the non-cash goodwill

impairment charge described below (the “Q4 Goodwill Impairment Charge”) of approximately $355 million, approximately $346

million after tax. The term “non-GAAP financial measure” is used to refer to a numerical measure of a company’s historical or future

financial performance, financial position or cash flows that: (i) excludes amounts, or is subject to adjustments that have the effect of

excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with U.S.

GAAP in a company’s statement of income, balance sheet or statement of cash flows; or (ii) includes amounts, or is subject to

adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and

presented. The Company believes that presenting non-GAAP financial measures that exclude the impact of those items enables it and

its shareholders to better assess the Company’s operating performance relative to its consolidated financial results in prior and future

periods and improves the comparability of the information presented. Readers are cautioned that adjusted revenue, adjusted gross

margin, adjusted gross margin percentage, adjusted net income and adjusted diluted earnings per share do not have any standardized

meaning prescribed by U.S. GAAP and are therefore unlikely to be comparable to similarly titled measures reported by other

companies. These non-GAAP financial measures should be considered in the context of the U.S. GAAP results, which are described

in this MD&A. A reconciliation of these non-GAAP financial measures to the most directly comparable U.S. GAAP measures was

included in the Company’s press release, dated March 29, 2012.

7