Blackberry 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

Foreign currency translation

The U.S. dollar is the functional and reporting currency of the Company. Foreign currency denominated assets and liabilities of

the Company and all of its subsidiaries are translated into U.S. dollars. Accordingly, monetary assets and liabilities are translated

using the exchange rates in effect at the consolidated balance sheet date and revenues and expenses at the rates of exchange

prevailing when the transactions occurred. Remeasurement adjustments are included in income. Non-monetary assets and

liabilities are translated at historical exchange rates.

Cash and cash equivalents

Cash and cash equivalents consist of balances with banks and liquid investments with maturities of three months or less at the

date of acquisition.

Accounts receivable, net

The accounts receivable balance which reflects invoiced and accrued revenue is presented net of an allowance for doubtful

accounts. The allowance for doubtful accounts reflects estimates of probable losses in accounts receivables. The Company is

dependent on a number of significant customers and on large complex contracts with respect to sales of the majority of its

products, software and services. The Company expects the majority of its accounts receivable balances to continue to come from

large customers as it sells the majority of its devices and software products and service relay access through network carriers and

resellers rather than directly.

The Company evaluates the collectability of its accounts receivables based upon a combination of factors on a periodic basis

such as specific credit risk of its customers, historical trends and economic circumstances. The Company, in the normal course

of business, monitors the financial condition of its customers and reviews the credit history of each new customer. When the

Company becomes aware of a specific customer’s inability to meet its financial obligations to the Company (such as in the case

of bankruptcy filings or material deterioration in the customer’s operating results or financial position, and payment

experiences), RIM records a specific bad debt provision to reduce the customer’s related accounts receivable to its estimated net

realizable value. If circumstances related to specific customers change, the Company’s estimates of the recoverability of

accounts receivables balances could be further adjusted. The allowance for doubtful accounts as at March 3, 2012 is $16 million

(February 26, 2011 - $2 million).

While the Company sells its products and services to a variety of customers, there were no customers that comprised more than

10% of the Company’s revenue in fiscal 2012 (February 26, 2011 – two customers comprised 11% each; February 27, 2010 -

three customers comprised 20%, 13% and 10% each).

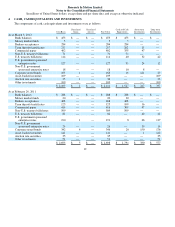

Investments

The Company’s cash equivalents and investments, other than cost method investments of $37 million (February 26, 2011 - $15

million) and equity method investments of $48 million (February 26, 2011 - $11 million), consisting of money market and other

debt securities, are classified as available-for-sale for accounting purposes and are carried at fair value, with unrealized gains

and losses recorded in accumulated other comprehensive income (loss) until such investments mature or are sold. The Company

determines the appropriate classification of investments at the time of purchase and subsequently reassesses the classification of

such investments at each balance sheet date. The Company uses the specific identification method of determining the cost basis

in computing realized gains or losses on available-for-sale investments which are recorded in investment income. In the event of

a decline in value which is other-than-temporary, the investment is written down to fair value with a charge to income. The

Company does not exercise significant influence with respect to any of these investments.

2