Blackberry 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

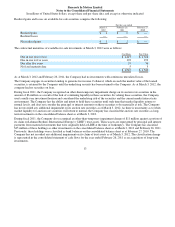

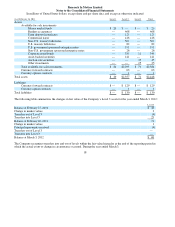

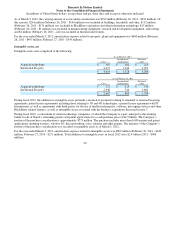

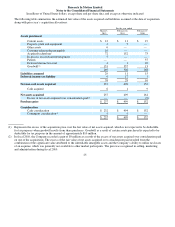

Based on the carrying value of the identified intangible assets as at March 3, 2012 and assuming no subsequent impairment of

the underlying assets, the annual amortization expense for the next five fiscal years is expected to be as follows: 2013 - $1.3

billion; 2014 - $447 million; 2015 - $331 million; 2016 - $263 million; and 2017 - $217 million.

The weighted-average remaining useful life of the acquired technology is 2.9 years (2011 – 3.5 years).

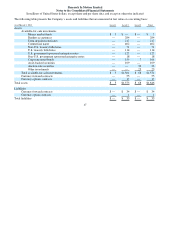

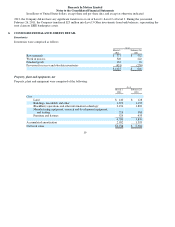

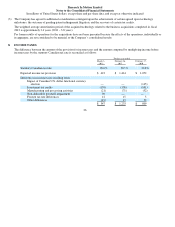

Goodwill

Changes to the carrying amount of goodwill during the fiscal year ended March 3, 2012 were as follows:

Goodwill is tested annually for impairment during the fourth quarter or more frequently if it is warranted by changes in events

and circumstances that indicate goodwill is more likely than not impaired. These events and circumstances may include a

significant change in legal factors or in the business climate, a significant decline in the Company’s share price, an adverse

action or assessment by a regulator, unanticipated competition, a loss of key personnel, significant disposal activity and the

testing of recoverability for a significant asset group.

Goodwill is tested for impairment using a two-step process. The first step involves comparing the Company’s estimated fair

value to its carrying amount, including goodwill. If the estimated fair value of the Company exceeds its carrying amount,

goodwill is not considered to be impaired. If the carrying amount exceeds the estimated fair value, there is an indication of

potential impairment and the second step of the goodwill impairment test is performed to measure the impairment amount. The

second step involves determining an implied fair value of goodwill for the Company, which is calculated by measuring the

excess of the estimated fair value of the Company over the aggregated estimated fair values of identifiable assets and liabilities.

The conduct of the second step involves significant judgment on the selection of assumptions necessary to arrive at an implied

fair value of goodwill. These assumptions include, but are not limited to, development of multi-year business cash flow

forecasts, the selection of discount rates and the identification and valuation of unrecorded assets. If, after conducting the second

step of the test, the carrying amount of goodwill exceeds its implied fair value, a non-cash impairment loss is recognized in an

amount equal to that excess.

During the fourth quarter ended March 3, 2012, the Company performed the first step of the annual impairment test. The

estimated fair value of the Company was determined utilizing a market-based approach and the Company’s market

capitalization was used as a key input for the determination of fair value of the Company. The Company’s market capitalization

was determined by multiplying the number of shares outstanding as at March 3, 2012 by the average closing market price of the

Company’s common shares over the preceding 5-day period. The Company used this duration in order to incorporate the

inherent market fluctuations that may affect any individual closing price of the Company’s shares. The Company believes that

market capitalization alone does not capture the fair value of the business as a whole, or the substantial value that an acquirer

would obtain from its ability to obtain control of the business. Consequently, the Company developed an estimate for the control

premium that a marketplace participant might pay to acquire control of the business in an arms-length transaction. The

determination of the control premium requires significant judgment and the Company observed recent market transactions as a

guide to establish a range of reasonably possible control premiums to estimate the Company’s fair value. The Company believes

that the main factor leading to the impairment was a decline in its

21

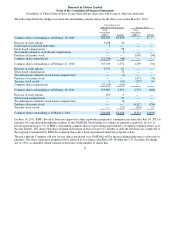

Balance as at Februar

y

26, 2011

$508

Goodwill ac

q

uired throu

g

h business combinations durin

g

the

p

eriod

151

Goodwill im

p

airment char

g

e

(355)

Balance as of March 3, 2012

$ 304