Blackberry 2012 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

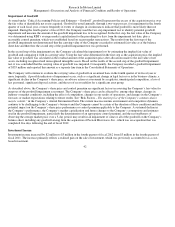

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

L

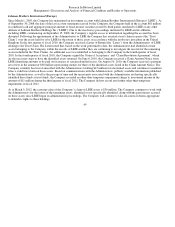

ehman Brothers International (Europe)

Since March 1, 2005, the Company has maintained an investment account with Lehman Brothers International (Europe) (“LBIE”). As

of September 30, 2008, the date of the last account statement received by the Company, the Company held in the account $81 million

in combined cash and aggregate principal amount of fixed-income securities issued by third parties unrelated to LBIE or any other

affiliate of Lehman Brothers Holdings Inc (“LBHI”). Due to the insolvency proceedings instituted by LBHI and its affiliates,

including LBIE, commencing on September 15, 2008, the Company’s regular access to information regarding the account has been

disrupted. Following the appointment of the Administrators to LBIE the Company has asserted a trust claim in specie (the “Trust

Claim”) over the assets held for it by LBIE for the return of those assets in accordance with the insolvency procedure in the United

Kingdom. In the first quarter of fiscal 2010, the Company received a Letter of Return (the “Letter”) from the Administrators of LBIE

relating to the Trust Claim. The Letter noted that, based on the work performed to date, the Administrators had identified certain

assets belonging to the Company within the records of LBIE and that they are continuing to investigate the records for the remaining

assets included in the Trust Claims. An additional asset was identified as belonging to the Company in the fourth quarter of fiscal

2010. In the fourth quarter of fiscal 2010, the Company signed the ‘Form of Acceptance’ and ‘Claim Resolution Agreement’, which

are the necessary steps to have the identified assets returned. On June 8, 2010, the Company received a Claim Amount Notice from

LBIE identifying amounts to be paid out in respect to certain identified assets. On August 10, 2010, the Company received a payment

net of fees in the amount of $38 million representing monies for three of the identified assets listed in the Claim Amount Notice. The

Company currently has trust claims filed with the Administrators totalling $47 million for unreturned assets and continues to maintain

it has a valid trust claim on those assets. Based on communications with the Administrators, publicly available information published

by the Administrators, as well as the passage of time and the uncertainty associated with the Administrator not having specifically

identified these funds as trust funds, the Company recorded an other-than-temporary impairment charge to investment income in the

amount of $11 million during the third quarter of fiscal 2011. The Company did not record any further other-than-temporary

impairments in fiscal 2012.

As at March 3, 2012, the carrying value of the Company’s claim on LBIE assets is $36 million. The Company continues to work with

the Administrators for the return of the remaining assets, identified or not specifically identified, along with the past interest accrued

on these assets since LBIE began its administration proceedings. The Company will continue to take all actions it deems appropriate

to defend its rights to these holdings.

49