Blackberry 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic relationships in the wireless data communications industry are also evolving. Specific infrastructure manufacturers, network

operators, content providers and other businesses within the industry may currently be customers of, suppliers to, strategic partners

with, or investors in other businesses. The Company is currently working with a number of businesses, some of which are direct

competitors with each other and others of which are current or potential competitors of RIM. It is unclear to what extent network

infrastructure developers, enterprise software vendors, PC or PDA vendors, key network operators or content providers and others

will seek to provide integrated wireless solutions, including access devices developed internally or through captive suppliers.

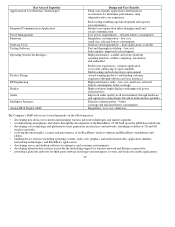

Providers of mobile operating system platforms that compete with RIM’s BlackBerry platform include Apple Inc. (iOS), Google Inc.

(Android), Microsoft Inc. (Windows Phone), and Nokia Corporation (Symbian). In the wireless data communications access market,

the Company is aware of a number of suppliers of access devices for public wireless data networks, including: Apple Inc.; Dell, Inc.;

Fujitsu Limited; General Dynamics Corporation; Hitachi America, Ltd.; HTC Corporation; Huawei Technologies Co. Ltd.; LG

Electronics Mobile Communications Company; Mitsubishi Corporation; Motorola Mobility Holdings, Inc.; NEC Corporation; Nokia

Corporation; Samsung Electronics Co., Ltd.; Sharp Corporation; Sony Corporation; and ZTE Corporation. In addition, the Company

faces competition from companies focused on providing middleware to facilitate end-to-end wireless messaging solutions. Companies

in this category include IBM Corporation; Microsoft Corporation; Notify Technology Corporation; Openwave Systems Inc.; Seven

Networks, Inc.; Sybase, Inc., and Good Technologies. Some of the Company’s competitors have greater name recognition, larger

customer bases, and significantly greater financial, technical, marketing, public relations, sales, distribution and other resources than

the Company does.

A variety of approaches are being pursued as diverse handset and handheld vendors attempt to provide mobile access to corporate

data. These approaches include smartphones, superphones, other mobile data devices such as tablets and netbooks, a variety of

middleware offerings and other end-to-end integrated wireless solutions.

A key aspect of competitive differentiation among industry participants involves the inclusion of a sophisticated NOC in the system

architecture. RIM pioneered the use of a sophisticated multi-node centralized architecture responsible for the routing of messages to

and from devices. The key benefits of the NOC are message delivery reliability, network utilization efficiency and security. By

isolating firewalls from the devices, NOCs avoid the need for numerous simultaneous inbound connections through the firewall which

is a significant security consideration for many IT managers. Other benefits of NOCs include eliminating the opportunity for Denial

of Service Attacks against the firewall, protecting against bad packets reaching devices, and enhancing service quality by providing

advanced compression and by acting as a buffer between the limited capacity of wireless networks and the massive capacity of the

wired environment.

It is important to note that some of the cost of operating the NOC is often charged directly to carriers by the solution vendor as is the

case with RIM. Carriers typically include the infrastructure access fee within data plans at the same or lower prices than data plans

provided for solutions without NOCs partly because of the superior network efficiency of NOC-based systems. As such, end users get

a better performing solution with a superior security model at the same or lower cost to products without NOCs.

27