Blackberry 2012 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

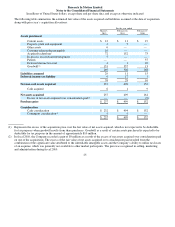

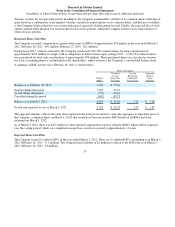

The Company determined that it is more likely than not that it can realize its deferred income tax assets. Accordingly, no

valuation allowance is required on its deferred income tax assets as at March 3, 2012 (February 26, 2011 - nil). The Company

will continue to evaluate and examine the valuation allowance on a regular basis, and when required, the valuation allowance

may be adjusted.

The Company has not provided for Canadian deferred income taxes or foreign withholding taxes that would apply on the

distribution of the income of its non-Canadian subsidiaries, as this income is intended to be reinvested indefinitely.

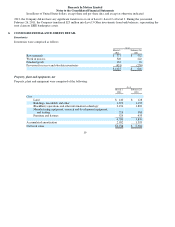

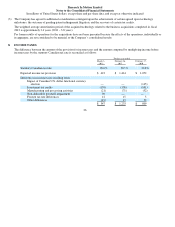

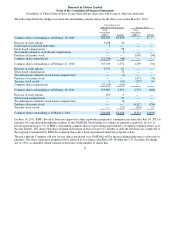

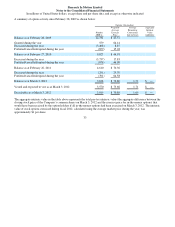

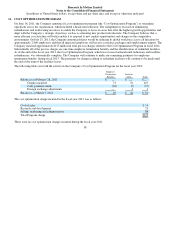

The Company’s total unrecognized income tax benefits as at March 3, 2012 and February 26, 2011 were $146 million and $164

million, respectively. A reconciliation of the beginning and ending amount of unrecognized income tax benefits that, if

recognized, would affect the Company’s effective tax rate is as follows:

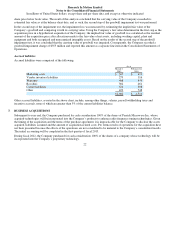

As at March 3, 2012, the total unrecognized income tax benefits of $146 million include approximately $121 million of

unrecognized income tax benefits that have been netted against related deferred income tax assets. The remaining $25 million is

recorded within current income taxes payable and other non-current taxes payable on the Company’s consolidated balance sheet

as of March 3, 2012.

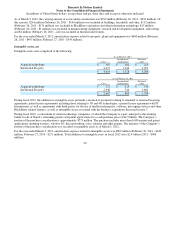

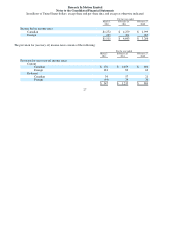

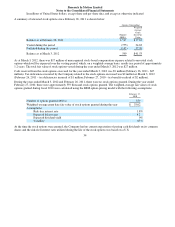

A summary of open tax years by major jurisdiction is presented below:

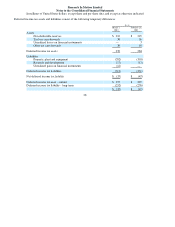

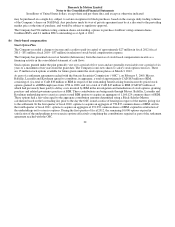

The Company is subject to ongoing examination by tax authorities in the jurisdictions in which it operates. The Company

regularly assesses the status of these examinations and the potential for adverse outcomes to determine the adequacy of the

provision for income taxes. The Canada Revenue Agency (“CRA”) recently concluded its examination of the Company’s fiscal

2006 to fiscal 2009 Canadian corporate tax filings. Although the audit concluded with no material adjustments to income taxes

payable, there remains uncertainty with respect to certain tax attributes that have resulted from the restructuring of RIM’s

international operations. The Company believes it is reasonably possible that approximately $142 million of its gross

unrecognized income tax benefit will decrease in the next twelve months, the majority of which relates to the tax attributes

resulting from the restructuring of RIM’s international operations. The Company has other non-Canadian income tax audits

pending. While the final resolution of these audits is uncertain, the Company believes the ultimate resolution of these audits will

not have a material adverse effect on its consolidated financial position, liquidity or results of operations.

29

(in millions)

Unrecognized income tax benefits balance as at February 26, 2011

$164

Increase for tax

p

ositions of

p

rior

y

ears

15

Settlement of tax

p

ositions

(8)

Ex

p

iration of statute of limitations

(24)

Other

(1)

Unreco

g

nized income tax benefits balance as at March 3, 2012

$146

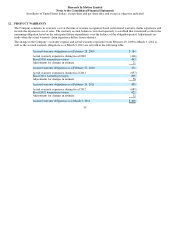

Canada

Fiscal 2006 - 2012

United States

Fiscal 2009 - 2012

United Kin

g

dom

Fiscal 2010 - 2012

(1) Includes federal as well as

p

rovincial and state

j

urisdictions, as a

pp

licable.

(1)

(1)