Blackberry 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

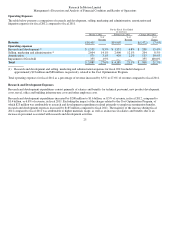

Q4 BlackBerry 7 Inventory Provision

During the fourth quarter of fiscal 2012, the Company recorded the Q4 BlackBerry 7 Inventory Provision consisting of pre-tax

charges of approximately $267 million, or approximately $197 million after-tax, relating primarily to certain BlackBerry 7 products

in its current portfolio of hardware devices. The charge was predominantly non-cash. The charges represent the Company’s estimates

of provisions required to sell through existing inventory in the channel and the level of excess and obsolete inventory, based on

estimated inventory levels of certain BlackBerry 7 products as of March 3, 2012. The Company also experienced a decrease in its

forward-looking demand relating to certain BlackBerry 7 products and as such, recorded a reduction in the carrying value of its

inventory, as well as increased its estimate of the excess inventory and contractual liabilities with its manufacturing partners for units

or materials relating to those products.

Goodwill

Goodwill represents the excess of the acquisition price over the fair value of identifiable net assets acquired. Goodwill is allocated as

at the date of the business combination. Goodwill is not amortized, but is tested for impairment annually, during the fourth quarter, or

more frequently if events or changes in circumstances indicate goodwill is more likely than not impaired. These events and

circumstances may include a significant change in legal factors or in the business climate, a significant decline in the Company’s

share price, an adverse action of assessment by a regulator, unanticipated competition, a loss of key personnel, significant disposal

activity, and the testing of recoverability for a significant asset group.

The goodwill impairment test prescribed by U.S. GAAP requires the Company to identify reporting units and to determine estimates

of the fair values of the Company’s reporting units as of the date it tests for impairment. Determining the fair value of the Company’s

reporting units for the purpose of testing the potential impairment of individual assets and goodwill requires significant judgment by

management. Different judgments could yield different results. For purposes of the Company’s goodwill impairment test, the

Company has conducted an assessment and concluded that it operates as a single reporting unit.

The impairment test is carried out in two steps. In the first step, the carrying amount of the reporting unit including goodwill is

compared with its estimated fair value. The estimated fair value is determined utilizing a market-based approach, based on the quoted

market price of the Company’s common shares, adjusted by an appropriate control premium. When the carrying amount of a

reporting unit exceeds its estimated fair value, goodwill of the reporting unit is considered to be impaired, and the second step is

necessary.

In the second step of the goodwill impairment test, the implied fair value of the reporting unit’s goodwill is compared with its

carrying amount to measure the amount of the impairment loss, if any. The implied fair value of goodwill is determined in the same

manner as the value of goodwill is determined in a business combination using the fair value of the reporting unit as if it were the

acquisition price. When the carrying amount of the reporting unit goodwill exceeds the implied fair value of the goodwill, an

impairment loss is recognized in an amount equal to the excess and is presented as a separate line item in the consolidated statements

of operations. Establishing an implied fair value of goodwill requires the Company to make estimates for key inputs into complex

valuation models and to apply significant judgment in the selection of estimates, assumptions and methodologies required to complete

the analysis. Specific examples of these areas include, but are not limited to, development of multi-year business cash flow forecasts,

the selection of discount rates and the identification and valuation of unrecorded assets.

15