Blackberry 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

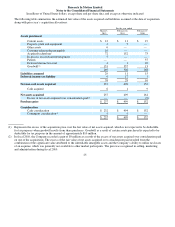

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

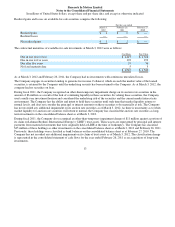

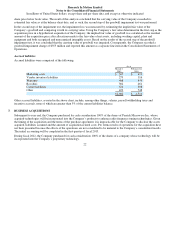

The Company corroborates the fair values provided by the independent third party for term deposits/certificates by comparing

those provided against fair values determined by the Company utilizing quoted prices from vendors for identical securities, or

the market prices of similar securities adjusted for observable inputs such as differences in maturity dates, interest rates and

credit ratings. The term deposits/certificates held by the Company are all issued by major banking organizations and all have

investment grade ratings.

The Company corroborates the fair values provided by the independent third party for commercial paper by comparing those

provided against fair values determined by the Company utilizing quoted prices from vendors for identical securities, or the

market prices of similar securities adjusted for observable inputs such as differences in maturity dates, interest rates, dealer

placed rates and credit ratings. The commercial paper held by the Company are all issued by major financing, corporate or

capital organizations and all have investment grade ratings.

The Company corroborates the fair values provided by the independent third party for non-U.S. treasury bills/notes by

comparing those provided against fair values determined by the Company utilizing quoted prices from vendors for identical

securities, or the market prices of similar securities adjusted for observable inputs such as differences in maturity dates, interest

rates and credit rating. All non-U.S. treasury bills/notes held by the Company are issued by the Federal and/or Provincial

Governments of Canada and all have investment grade ratings.

The Company corroborates the fair values provided by the independent third party for U.S. treasury bills/notes by comparing

those provided against fair values determined by the Company utilizing quoted prices from vendors for identical securities as

provided by U.S. government bond dealers. All U.S. treasury bills/notes held by the Company are issued by the United States

Department of the Treasury and all have investment grade ratings.

The Company corroborates the fair values provided by the independent third party for U.S. government sponsored enterprise

notes by comparing those provided against fair values determined by the Company utilizing quoted prices from vendors for

identical securities as provided by U.S. government bond dealers or prices as provided by the published index of U.S. Agency

securities. The U.S. government sponsored enterprise notes held by the Company are primarily agency notes and collateralized

mortgage obligations issued and backed by government organizations such as Freddie Mac and Fannie Mae and all have

investment grade ratings.

The Company corroborates the fair values provided by the independent third party for non-U.S. government sponsored

enterprise notes by comparing those provided against fair values determined by the Company utilizing quoted prices from

vendors for identical securities, or the market prices of similar securities adjusted for observable inputs such as differences in

maturity dates, interest rates and credit ratings. The non-U.S. government sponsored enterprise notes held by the Company are

primarily issued by investment banks backed by European or Latin American countries and all have investment grade ratings.

The Company corroborates the fair values provided by the independent third party for corporate notes/bonds (other than those

classified as Level 3) by comparing those provided against fair values determined by the Company utilizing quoted prices from

vendors for identical securities, or the market prices of similar securities adjusted for observable inputs such as differences in

maturity dates, interest rates, yield curves, swap rates, credit ratings, industry comparable trades and spread history. The

corporate notes/bonds held by the Company are all issued by major corporate organizations and all have investment grade

ratings.

15