Blackberry 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

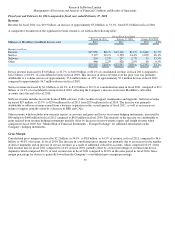

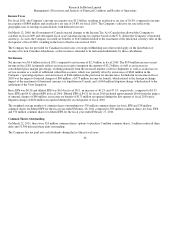

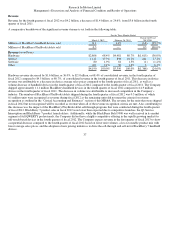

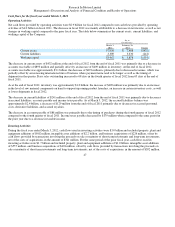

Service revenue increased by $244 million, or 27.2%, to $1.1 billion, or 27.3% of consolidated revenue in the fourth quarter of fiscal

2012, compared to $898 million, or 16.2% of consolidated revenue, in the fourth quarter of fiscal 2011, primarily reflecting the

Company’s increase in BlackBerry subscriber accounts since the fourth quarter of fiscal 2011 and the 14 week in the fourth quarter

of fiscal 2012. Given that many of the Company’s competitors recover their infrastructure and services expense in alternate manners,

the Company is facing greater pressure to reduce its monthly infrastructure access fees. In addition, the infrastructure access fees

charged by the Company may also fall under pressure if the new products it launches do not utilize the network infrastructure in the

same way or to the same extent as the Company’s existing products. The Company is focused on developing an integrated services

offering that leverages RIM’s strengths such as BBM, security and manageability that will generate service revenues. However, if the

Company is unable to resist these competitive pressures or is unable to develop a compelling integrated services offering that will

generate service revenues and enable the Company to recover the costs associated with its network infrastructure, this could have a

material adverse affect on the Company’s results of operations and financial condition.

Software revenue decreased by $1 million, or 1.2%, to $80 million in the fourth quarter of fiscal 2012 from $81 million in the fourth

quarter of fiscal 2011. This decrease was primarily attributable to a decrease in BES and CALs.

Other revenue increased by $6 million to $102 million in the fourth quarter of fiscal 2012 compared to $96 million in the fourth

quarter of fiscal 2011. The majority of the increase was attributable to gains realized from revenue hedging instruments, partially

offset by a decrease in non-warranty repairs revenue. See “Market Risk of Financial Instruments – Foreign Exchange” for additional

information on the Company’s hedging instruments.

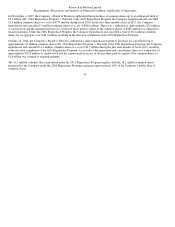

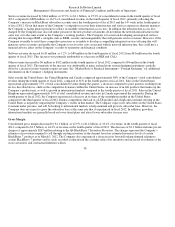

Sales outside the United States, the United Kingdom and Canada comprised approximately 68% of the Company’s total consolidated

revenue during the fourth quarter of fiscal 2012, compared to 61% in the fourth quarter of fiscal 2011. Sales in the United States

represented approximately 17% of total consolidated revenue during the quarter, a decrease compared to prior quarters resulting from

factors described above, shifts in the competitive dynamics within the United States, an increase of in-life products that makes up the

Company’s product mix, as well as growth in international markets compared to the fourth quarter of fiscal 2011. Sales in the United

Kingdom represented approximately 10% of total consolidated revenue and sales in Canada represented the remainder. During the

fourth quarter of fiscal 2012, the Company experienced a decrease in its share of the smartphone market in the United States

compared to the third quarter of fiscal 2012. Intense competition, the lack of a LTE product and a high-end consumer offering in the

United States is negatively impacting the Company’s results in that market. The Company expects net subscribers in the United States

to remain under pressure, and will be looking to international markets to help maintain and grow its subscriber base. However, the

Company does not expect to grow the subscriber base at the same rate that it experienced in fiscal 2012. In addition, growth in

international markets are generally based on lower-tiered plans and attract lower subscriber fees per user.

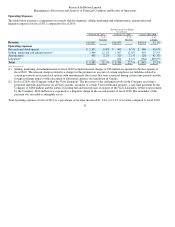

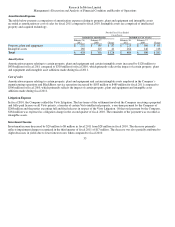

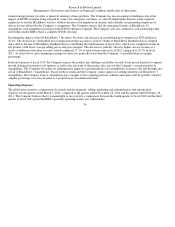

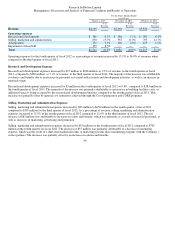

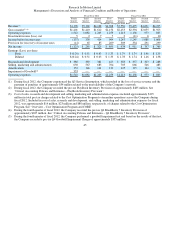

Gross Margin

Consolidated gross margin decreased by $1.1 billion, or 42.9%, to $1.4 billion, or 33.4% of revenue, in the fourth quarter of fiscal

2012, compared to $2.5 billion, or 44.2% of revenue, in the fourth quarter of fiscal 2011. The decrease of $1.1 billion includes pre-tax

charges of approximately $267 million relating to the Q4 BlackBerry 7 Inventory Provision. The charges represent the Company’s

estimates of provisions required to sell through existing inventory in the channel based on estimated inventory levels of certain

BlackBerry 7 products as of March 3, 2012. The Company also experienced a decrease in its forward looking demand relating to

certain BlackBerry 7 products and as such, recorded a reduction in the carrying value of its inventory and increased its estimate of the

excess inventory and contractual liabilities with its

38

th