Blackberry 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

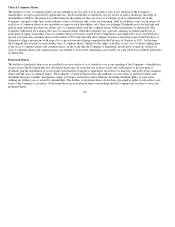

The Company had a total cash, cash equivalents and investments of $2.1 billion as at March 3, 2012, compared to $2.7 billion as at

February 26, 2011. The Company’s investment income increased by $13 million to $21 million in fiscal 2012 from $8 million in

fiscal 2011. Cash equivalents, short term and other investments are invested primarily in debt securities of varying maturities.

Consequently, the Company is exposed to interest rate risk and its results of operations may be adversely affected by changes in

interest rates. The fair value of short term and other investments, as well as the investment income derived from the investment

portfolio, will fluctuate with changes in prevailing interest rates.

Additionally, the Company is exposed to market and credit risk on its investment portfolio. While the Company’s investment policies

include investing in liquid, investment-grade securities and limiting investments in any single issuer, there can be no assurance that

such investment policies will reduce or eliminate market or credit risks. See “Financial Condition” in Management’s Discussion and

Analysis of Financial Condition and Results of Operations for fiscal 2012 for a discussion of certain liquidity issues relating to the

Company’s investments in auction rate securities, structured investment vehicles and fixed income securities maintained in an

investment account with Lehman Brothers International (Europe).

Proposed regulations relating to conflict minerals may have an adverse affect on the Company’s business.

Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, requires the SEC to promulgate new

disclosure requirements for manufacturers of products containing certain minerals that are mined from the Democratic Republic of

Congo and adjoining countries. These so-called “conflict minerals” are commonly found in metals used in the manufacture of certain

of the Company’s products. Promulgation of the SEC’s final rules is anticipated to occur in the first half of fiscal 2013. The

implementation of these new regulations may limit the sourcing and availability, or may increase the costs, of some of the metals used

in the manufacture of the Company’s products. The regulations may also reduce the number of suppliers who provide conflict-free

metals, and may affect the Company’s ability to obtain products in sufficient quantities or at competitive prices. Also, since the

Company’s supply chain is complex, the Company may face reputational challenges if RIM is unable to sufficiently verify the origins

for all metals used in the Company’s products through the due diligence procedures that RIM implements.

Failure of the Company’s suppliers, subcontractors, third-party distributors and representatives to use acceptable

ethical business practices or to comply with applicable laws, including proposed regulations related to conflict minerals,

could negatively impact the Company’s business.

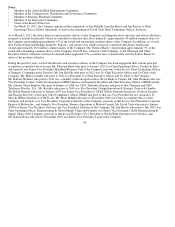

The Company expects its suppliers and subcontractors to operate in compliance with applicable laws, rules and regulations regarding

working conditions, labor and employment practices, environmental compliance, anti-corruption (including the Foreign Corrupt

Practices Act of the United States, the Corruption of Foreign Public Officials Act of Canada and the UK Bribery Act), and patent and

trademark licensing as detailed in the Company’s Supplier Code of Conduct. However, the Company does not directly control their

labor and other business practices. If one of the Company’s suppliers or subcontractors violates applicable labor, anti-corruption or

other laws, or implements labor or other business practices that are regarded as unethical, or if a supplier or subcontractor fails to

comply with procedures designed by the Company to adhere to existing or proposed regulations, including the sourcing of so-called

“conflict minerals” for the Company’s products, the shipment of finished products to the Company could be interrupted, orders could

be canceled, relationships could be terminated, the Company’s reputation could be damaged, and the Company may be subject to

liability. For example, if one of the Company’s suppliers or subcontractors fails to procure necessary intellectual property rights, legal

action could be taken against the Company that could impact the salability of the Company’s products and expose the Company to

financial obligations to a third party. Representations and warranties provided to the Company may turn out to be inaccurate, and

indemnities provided by such suppliers or subcontractors to the Company may not be sufficient to avoid liability. Any of these events

could have a negative impact on the Company’s business, results of operations and financial condition.

75