Blackberry 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

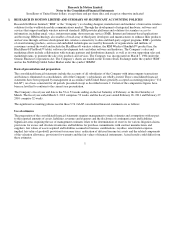

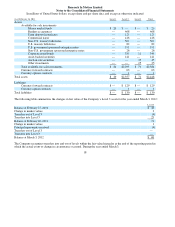

market by a trustee selected by the Company or the cash equivalent on the vesting dates established by the Board of Directors or

the Compensation, Nomination and Governance Committee of the Board of Directors. The RSUs vest over a three-year period,

either on the third anniversary date or in equal instalments on each anniversary date over the vesting period. The Company

classifies RSUs as equity instruments as the Company has the ability and intent to settle the awards in shares. The compensation

expense is calculated based on the fair value of each RSU as determined by the closing value of the Company’s common shares

on the business day of the grant date. The Company recognizes compensation expense over the vesting period of the RSU.

Upon issuance of the RSU, common shares for which RSUs may be exchanged will be purchased on the open market by a

trustee selected and funded by the Company. The trustee has been appointed to settle the Company’s obligation to deliver shares

to individuals upon vesting. In addition, upon vesting, the trustee is required to sell enough shares to cover the individual

recipient’s minimum statutory withholding tax requirement, with the remaining shares delivered to the individual. As the

Company is considered to be the primary beneficiary of the trust, the trust is considered a variable interest entity and is

consolidated by the Company.

The Company has a Deferred Share Unit Plan (the “DSU Plan”), adopted by the Board of Directors on December 20, 2007,

under which each independent director will be credited with Deferred Share Units (“DSUs”) in satisfaction of all or a portion of

the cash fees otherwise payable to them for serving as a director of the Company. Grants under the DSU plan replace the stock

option awards that were historically granted to independent members of the Board of Directors. At a minimum, 60% of each

independent director’s annual retainer will be satisfied in the form of DSUs. The director can elect to receive the remaining 40%

in any combination of cash and DSUs. Within a specified period after such a director ceases to be a director, DSUs will be

redeemed for cash with the redemption value of each DSU equal to the weighted average trading price of the Company’s shares

over the five trading days preceding the redemption date. Alternatively, subject to receipt of shareholder approval, the Company

may elect to redeem DSUs by way of shares purchased on the open market or issued by the Company. DSUs are accounted for

as liability-classified awards and are awarded on a quarterly basis. These awards are measured at their fair value on the date of

issuance, and remeasured at each reporting period, until settlement.

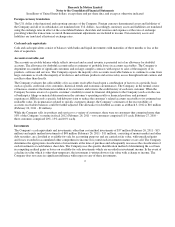

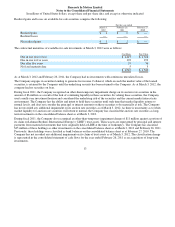

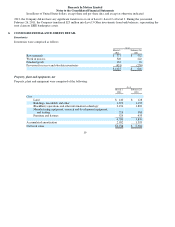

Warranty

The Company provides for the estimated costs of product warranties at the time revenue is recognized. BlackBerry devices are

generally covered by a time-limited warranty for varying periods of time. The Company’s warranty obligation is affected by

product failure rates, differences in warranty periods, regulatory developments with respect to warranty obligations in the

countries in which the Company carries on business, freight expense, and material usage and other related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return rates and unit warranty

repair costs. If the Company experiences increased or decreased warranty activity, or increased or decreased costs associated

with servicing those obligations, revisions to the estimated warranty liability would be recognized in the reporting period when

such revisions are made.

Advertising costs

The Company expenses all advertising costs as incurred. These costs are included in selling, marketing and administration.

9