Blackberry 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

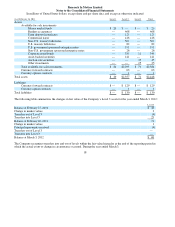

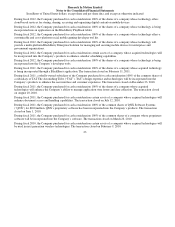

The Company corroborates the fair values provided by the independent third party for asset-backed securities by comparing

those provided against fair values determined by the Company utilizing quoted prices from vendors for identical securities, or

the market prices of similar securities adjusted for different observable inputs such as differences in swap rates and spreads,

credit ratings, pricing changes relative to asset class, priority in capital structure, principal payment windows, and maturity

dates. All asset-backed securities held by the Company are issued by government or consumer agencies and are primarily

backed by commercial automobile and equipment loans and leases. All asset-backed securities held by the Company have

investment grade ratings.

Fair values for all investment categories provided by the independent third party that are in excess of 0.5% from the fair values

determined by the Company are communicated to the third party for consideration of reasonableness. The independent third

party considers the information provided by the Company before determining whether a change in the original pricing is

warranted.

The fair values of corporate notes/bonds classified as Level 3, which represent investments in securities for which there is not an

active market, are estimated via cash flow pricing methodology using unobservable inputs such as actual monthly interest and

principal payments received, maturity rates of holdings, historical prices realized on sales, defaults experienced, maturity

extension risk, pricing for similar securities, collateral value, and recovery value for similar securities. The corporate

notes/bonds classified as Level 3 held by the Company consist of securities received in a payment-in-kind distribution from a

former structured investment vehicle.

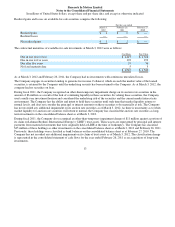

The fair value of auction rate securities is estimated using a discounted cash flow model incorporating maturity dates,

contractual terms and assumptions concerning liquidity and credit adjustments of the security sponsor to determine timing and

amount of future cash flows. The fair value includes an impairment charge of $6 million recognized in fiscal 2011 as discussed

in note 4.

The fair value of other investments is represented by the trust claim on LBIE bankruptcy assets and is estimated using

unobservable inputs such as estimated recovery values and prices observed on market activity for similar LBIE bankruptcy

claims. The fair value includes an impairment charge of $11 million recognized in fiscal 2011 as discussed in note 4.

The fair value of currency forward contracts and currency option contracts has been determined using notional and exercise

values, transaction rates, market quoted currency spot rates, forward points and interest rate yield curves. For currency forward

contracts and currency option contracts, the estimates presented herein are not necessarily indicative of the amounts that the

Company could realize in a current market exchange. Changes in assumptions could have a significant effect on the estimates.

16