Blackberry 2012 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

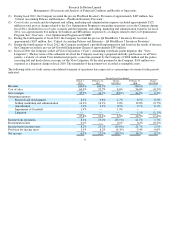

The Company’s estimates of costs are based upon historical experience and expectations of future return rates and unit warranty

repair cost. To the extent that the Company experiences changes in warranty activity, or changes to costs associated with servicing

those obligations, revisions to the estimated warranty liability would be required. For further details on the Company’s warranty

expense experience and estimates for fiscal 2012, refer to Note 12 to the Consolidated Financial Statements.

I

ncome Sensitivity

The Company estimates that a 10% change to either the current average unit warranty repair cost or the current average warranty

return rate, measured against the device sales volumes currently under warranty as at March 3, 2012, would have resulted in

adjustments to warranty expense and pre-tax income of approximately $41 million, or 3.5% of consolidated annual net income.

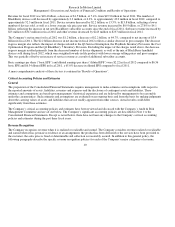

Investments

The Company’s cash equivalents and investments, other than cost method investments of $37 million and equity method investments

of $48 million, consist of money market and other debt securities, and are classified as available-for-sale for accounting purposes and

are carried at fair value with unrealized gains and losses recorded in accumulated other comprehensive income until such investments

mature or are sold. The Company uses the specific identification method of determining the cost basis in computing realized gains or

losses on available-for-sale investments which are recorded in investment income. In the event of a decline in value which is other

than temporary, the investment is written down to fair value with a charge to income.

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. When determining the fair value measurements for assets and

liabilities required to be recorded at fair value, the Company considers the principal or most advantageous market in which it would

transact and considers assumptions that market participants would use in pricing the asset or liability, such as inherent risk, non-

performance risk and credit risk. The Company applies the following fair value hierarchy, which prioritizes the inputs used in the

valuation methodologies in measuring fair value into three levels:

The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize the use of unobservable

inputs when measuring fair value.

The carrying amounts of the Company’s cash and cash equivalents, accounts receivable, other receivables, accounts payable and

accrued liabilities approximate fair value due to their short maturities.

17

•

Level 1 - Unad

j

usted

q

uoted

p

rices at the measurement date for identical assets or liabilities in active markets;

•

Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and

liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or

other in

p

uts that are observable or can be corroborated b

y

observable market data; and

•

Level 3 - Si

g

nificant unobservable in

p

uts which are su

pp

orted b

y

little or no market activit

y

.