Blackberry 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

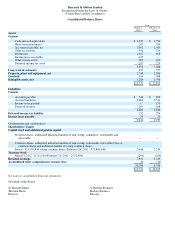

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

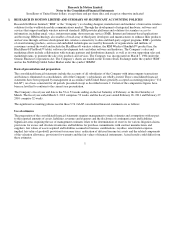

effectiveness. If an anticipated transaction is deemed no longer likely to occur, the corresponding derivative instrument is de-

designated as a hedge and any associated deferred gains and losses in accumulated other comprehensive income are recognized

in income at that time. Any future changes in the fair value of the instrument are recognized in current income. The Company

did not reclassify any losses from accumulated other comprehensive income (loss) into income as a result of the de-designation

of any derivative instrument as a hedge during fiscal 2012 (fiscal 2011 – nil).

For any derivative instruments that do not meet the requirements for hedge accounting, or for any derivative instruments for

which hedge accounting is not elected, the changes in fair value of the instruments are recognized in income in the current

period and will generally offset the changes in the U.S. dollar value of the associated asset, liability, or forecasted transaction.

Inventories

Raw materials are stated at the lower of cost and replacement cost. Work in process and finished goods inventories are stated at

the lower of cost and net realizable value. Cost includes the cost of materials plus direct labour applied to the product and the

applicable share of manufacturing overhead. Cost is determined on a first-in-first-out basis.

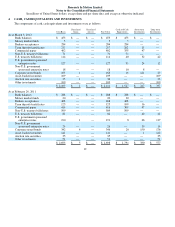

Property, plant and equipment, net

Property, plant and equipment is stated at cost less accumulated amortization. No amortization is provided for construction in

progress until the assets are ready for use. Amortization is provided using the following rates and methods:

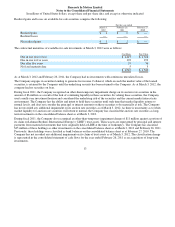

Goodwill

Goodwill represents the excess of the acquisition price over the fair value of identifiable net assets acquired. Goodwill is

allocated as at the date of the business combination. Goodwill is not amortized, but is tested for impairment annually, during the

fourth quarter, or more frequently if events or changes in circumstances indicate the asset may be impaired. These events and

circumstances may include a significant change in legal factors or in the business climate, a significant decline in the Company’s

share price, an adverse action of assessment by a regulator, unanticipated competition, a loss of key personnel, significant

disposal activity and the testing of recoverability for a significant asset group.

The Company consists of a single reporting unit. The impairment test is carried out in two steps. In the first step, the carrying

amount of the reporting unit including goodwill is compared with its fair value. The estimated fair value is determined utilizing a

market-based approach, based on the quoted market price of the Company’s stock in an active market, adjusted by an

appropriate control premium. When the carrying amount of a reporting unit exceeds its fair value, goodwill of the reporting unit

is considered to be impaired, and the second step is necessary.

4

Buildin

g

s, leaseholds and other

Strai

g

ht-line over terms between 5 and 40

y

ears

BlackBerr

y

o

p

erations and other information technolo

gy

Strai

g

ht-line over terms between 3 and 5

y

ears

Manufacturing equipment, research and development

e

q

ui

p

ment and toolin

g

Strai

g

ht-line over terms between 2 and 8

y

ears

Furniture and fixtures

Declinin

g

balance at 20%

p

er annum