Blackberry 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

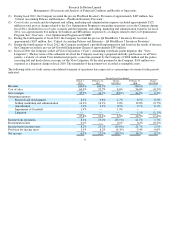

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

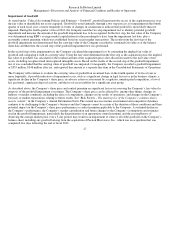

Significant judgment is required in evaluating the Company’s uncertain tax positions and provision for income taxes. The Company

uses a two-step process in assessing its uncertain tax positions. The two-step process separates recognition from measurement. The

first step is determining whether a tax position has met the recognition threshold by determining if the weight of available evidence

indicates that it is more likely than not to be sustained upon examination. The second step is measuring a tax position that has met the

recognition threshold as the largest amount of benefit that is more than 50% likely of being realized upon settlement. The Company

continually assesses the likelihood and amount of potential adjustments and adjusts the income tax provisions, income tax payable

and deferred taxes in the period in which the facts that give rise to a revision become known. The Company recognizes interest and

penalties related to uncertain tax positions as interest expense that is netted and reported within investment income. For further

details, refer to Note 8 to the Consolidated Financial Statements.

The Company uses the flow-through method to account for investment tax credits (“ITCs”) earned on eligible scientific research and

experimental development expenditures. The Company applies judgement in determining which expenditures are eligible to be

claimed. Under this method, the ITCs are recognized as a reduction to income tax expense.

The Company’s provision for income taxes is based on a number of estimates and assumptions as determined by management and is

calculated in each of the jurisdictions in which it conducts business. The Company’s consolidated income tax rates have differed from

statutory rates primarily due to the tax impact of ITCs, manufacturing activities, the amount of net income earned in Canada versus

other operating jurisdictions and the rate of taxes payable in respect of those other operating jurisdictions, the timing of reversal of

temporary differences and the rate of taxes applied on these differences, permanent differences including non-deductible stock

compensation and the impact of foreign exchange. The Company enters into transactions and arrangements in the ordinary course of

business in which the tax treatment is not entirely certain. In particular, certain countries in which it operates could seek to tax a

greater share of income than has been provided. The final outcome of any audits by taxation authorities may differ from estimates and

assumptions used in determining the Company’s consolidated tax provision and accruals, which could result in a material effect on

the consolidated income tax provision and the net income for the period in which such determinations are made.

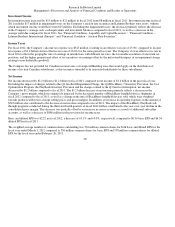

Stock-Based Compensation

The Company has an incentive stock option plan for officers and employees of the Company or its subsidiaries.

The Company estimates stock-based compensation expense for stock options at the grant date based on the award’s fair value as

calculated by the Black-Scholes-Merton (“BSM”) option-pricing model and is recognized rateably over the vesting period. The BSM

model requires various judgmental assumptions including volatility, forfeiture rates and expected option life. If any of the

assumptions used in the BSM model change significantly, stock-based compensation expense may differ materially in the future from

that recorded in the current period.

19