Berkshire Hathaway 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Equity Price Risk (Continued)

We are also subject to equity price risk with respect to our equity index put option contracts. While our ultimate potential

loss with respect to these contracts is determined from the movement of the underlying stock index between the contract

inception date and expiration date, the change in fair value resulting from current changes in the index values are also affected

by changes in other factors such as interest rates, expected dividend rates and the remaining duration of the contract. These

contracts expire between 2018 and 2026 and may not be unilaterally settled before their respective expiration dates.

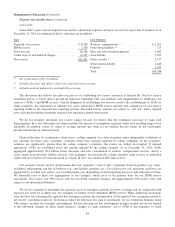

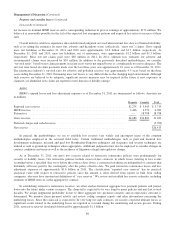

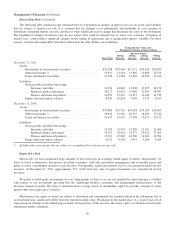

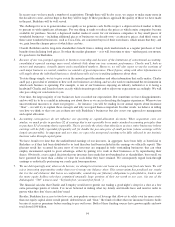

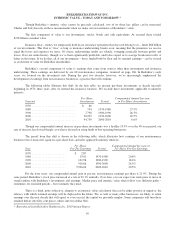

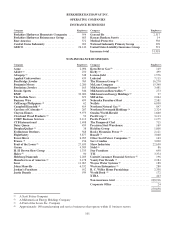

The following table summarizes our equity and other investments and derivative contract liabilities with equity price risk

as of December 31, 2011 and 2010. The effects of a hypothetical 30% increase and a 30% decrease in market prices as of those

dates are also shown. The selected 30% hypothetical changes do not reflect what could be considered the best or worst case

scenarios. Indeed, results could be far worse due both to the nature of equity markets and the aforementioned concentrations

existing in our equity investment portfolio. Dollar amounts are in millions.

Fair Value

Hypothetical

Price Change

Estimated

Fair Value after

Hypothetical

Change in Prices

Hypothetical

Percentage

Increase (Decrease) in

Shareholders’ Equity

December 31, 2011

Assets:

Equity securities ........................... $76,991 30% increase $100,088 9.1

30% decrease 53,894 (9.1)

Other investments (1) ........................ 7,432 30% increase 9,679 0.9

30% decrease 5,708 (0.7)

Liabilities:

Equity index put option contracts .............. 8,499 30% increase 6,156 0.9

30% decrease 11,949 (1.4)

December 31, 2010

Assets:

Equity securities ........................... $61,513 30% increase $ 79,967 7.6

30% decrease 43,059 (7.6)

Other investments (1) ........................ 8,668 30% increase 11,260 1.1

30% decrease 5,956 (1.1)

Liabilities:

Equity index put option contracts .............. 6,712 30% increase 4,687 0.8

30% decrease 9,859 (1.3)

(1) Includes other investments that possess significant equity price risk.

Foreign Currency Risk

We generally do not use derivative contracts to hedge foreign currency price changes primarily because of the natural

hedging that occurs between assets and liabilities denominated in foreign currencies in the Consolidated Financial Statements.

Financial statements of subsidiaries that do not use the U.S. Dollar as their functional currency are translated into U.S. Dollars

using period-end exchange rates for assets and liabilities and weighted-average exchange rates for revenues and expenses.

Adjustments resulting from translating the financial statements of these subsidiaries are reported in accumulated other

comprehensive income. Foreign currency transaction gains or losses are included in earnings primarily as a result of the

translation of foreign currency denominated assets and liabilities held by our U.S. subsidiaries. In addition, we hold investments

in major multinational companies that have significant foreign business and foreign currency risk of their own, such as The

Coca-Cola Company.

Our net assets subject to translation are primarily in our insurance and utilities and energy businesses, and to a lesser extent

in our manufacturing and services businesses. The translation impact is somewhat offset by transaction gains or losses on net

reinsurance liabilities of certain U.S. subsidiaries that are denominated in foreign currencies as well as the equity index put

option liabilities of U.S. subsidiaries relating to contracts that would be settled in foreign currencies.

91