Berkshire Hathaway 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

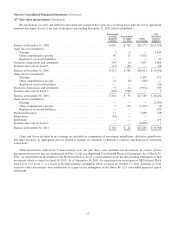

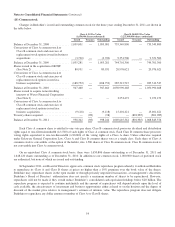

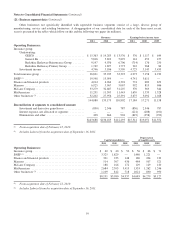

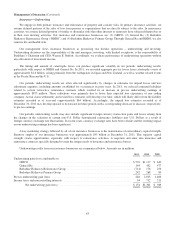

Notes to Consolidated Financial Statements (Continued)

(17) Fair value measurements (Continued)

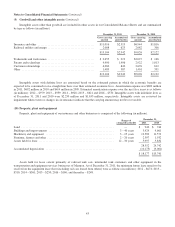

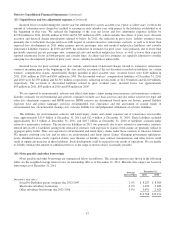

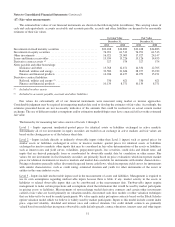

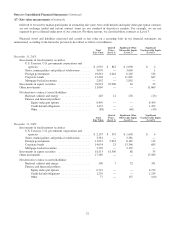

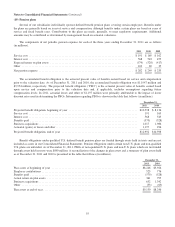

Reconciliations of assets and liabilities measured and carried at fair value on a recurring basis with the use of significant

unobservable inputs (Level 3) for each of the three years ending December 31, 2011 follow (in millions).

Investments

in fixed

maturity

securities

Investments

in equity

securities

Other

investments

Net

derivative

contract

liabilities

Balance at December 31, 2008 ...................................... $639 $328 $10,275 $(14,519)

Gains (losses) included in:

Earnings ................................................... 1 4 — 3,635

Other comprehensive income ................................... 49 25 4,702 —

Regulatory assets and liabilities ................................. — — — 47

Purchases, dispositions and settlements ............................... 244 (8) 5,637 1,664

Transfers into (out of) Level 3 ...................................... (15) (45) — (23)

Balance at December 31, 2009 ...................................... $918 $304 $20,614 $ (9,196)

Gains (losses) included in:

Earnings ................................................... — — 1,305 471

Other comprehensive income ................................... 16 (8) (358) —

Regulatory assets and liabilities ................................. — — — (33)

Purchases, dispositions and settlements ............................... 9 (1) (3,972) 533

Transfers into (out of) Level 3 ...................................... (142) (260) — 3

Balance at December 31, 2010 ...................................... $801 $ 35 $17,589 $ (8,222)

Gains (losses) included in:

Earnings ................................................... — — — (2,035)

Other comprehensive income ................................... 5 (13) (2,120) (3)

Regulatory assets and liabilities ................................. — — — 144

Purchases/Issuances .............................................. 17 — 5,000 (68)

Dispositions .................................................... (39) — — —

Settlements ..................................................... — — — 275

Transfers into (out of) Level 3 ...................................... — — (8,800) 1

Balance at December 31, 2011 ...................................... $784 $ 22 $11,669 $ (9,908)

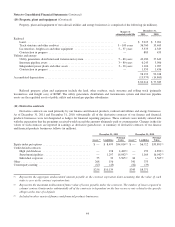

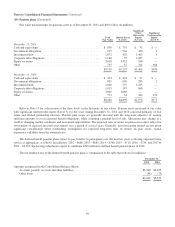

Gains and losses included in net earnings are included as components of investment gains/losses, derivative gains/losses

and other revenues, as appropriate and are related to changes in valuations of derivative contracts and disposal or settlement

transactions.

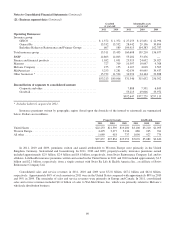

Other investments with Level 3 measurements over the past three years included our investments in various private

placement transactions that are summarized in Note 5 to the accompanying Consolidated Financial Statements. As of March 31,

2011, we transferred our investment in GS Preferred Stock to Level 2 measurements given the then pending redemption of that

investment which occurred on April 18, 2011. As of September 30, 2011, we transferred our investment in GE Preferred Stock

from Level 3 to Level 2, as a result of the then pending redemption which occurred on October 17, 2011. Earnings in 2010

related to other investments were attributable to a gain on the redemption of the Swiss Re 12% convertible perpetual capital

instrument.

53