Berkshire Hathaway 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

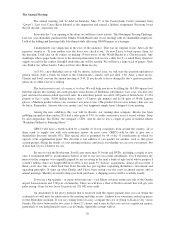

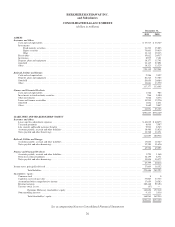

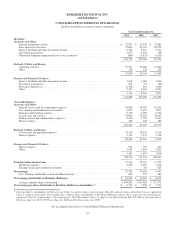

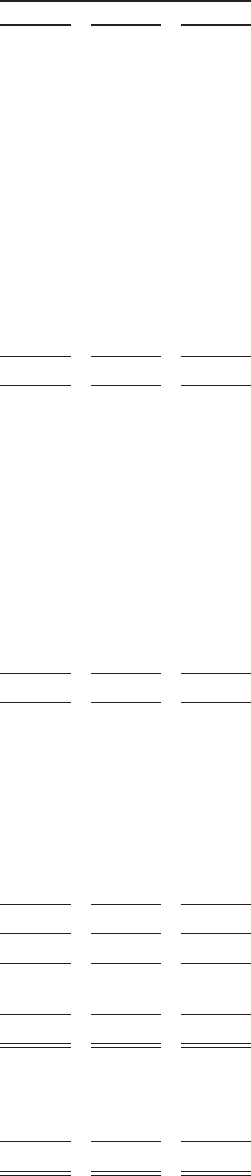

BERKSHIRE HATHAWAY INC.

and Subsidiaries

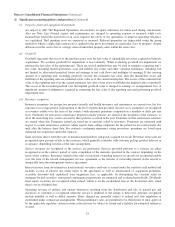

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Year Ended December 31,

2011 2010 2009

Cash flows from operating activities:

Net earnings ................................................................ $10,746 $ 13,494 $ 8,441

Adjustments to reconcile net earnings to operating cash flows:

Investment (gains) losses and other-than-temporary impairment losses ............. (1,274) (2,085) 2,837

Depreciation ............................................................ 4,683 4,279 3,127

Other ................................................................. 811 255 (149)

Changes in operating assets and liabilities before business acquisitions:

Losses and loss adjustment expenses ........................................ 3,063 1,009 2,165

Deferred charges reinsurance assumed ....................................... (329) 147 (39)

Unearned premiums ...................................................... 852 110 (21)

Receivables and originated loans ........................................... (1,159) (1,979) 697

Derivative contract assets and liabilities ...................................... 1,881 (880) (5,441)

Income taxes ........................................................... 1,493 2,348 2,035

Other assets ............................................................ (1,601) (1,070) 2,438

Other liabilities ......................................................... 1,310 2,267 (244)

Net cash flows from operating activities .......................................... 20,476 17,895 15,846

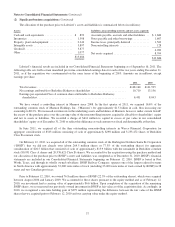

Cash flows from investing activities:

Purchases of fixed maturity securities ............................................ (7,362) (9,819) (10,798)

Purchases of equity securities .................................................. (15,660) (4,265) (4,570)

Purchases of other investments ................................................. (5,000) — (7,068)

Sales of fixed maturity securities ............................................... 3,353 5,435 4,338

Redemptions and maturities of fixed maturity securities ............................. 6,872 6,517 5,234

Sales of equity securities ...................................................... 1,518 5,886 5,626

Redemptions of other investments .............................................. 12,645 — —

Purchases of loans and finance receivables ........................................ (1,657) (3,149) (854)

Principal collections on loans and finance receivables ............................... 2,915 3,498 796

Acquisitions of businesses, net of cash acquired ................................... (8,685) (15,924) (108)

Purchases of property, plant and equipment ....................................... (8,191) (5,980) (4,937)

Other ..................................................................... 63 (476) 1,180

Net cash flows from investing activities .......................................... (19,189) (18,277) (11,161)

Cash flows from financing activities:

Proceeds from borrowings of insurance and other businesses ......................... 2,091 8,204 289

Proceeds from borrowings of railroad, utilities and energy businesses .................. 2,290 1,731 1,241

Proceeds from borrowings of finance businesses ................................... 1,562 1,539 1,584

Repayments of borrowings of insurance and other businesses ......................... (2,307) (430) (746)

Repayments of borrowings of railroad, utilities and energy businesses .................. (2,335) (777) (444)

Repayments of borrowings of finance businesses .................................. (1,959) (2,417) (396)

Changes in short term borrowings, net ........................................... 301 370 (885)

Acquisitions of noncontrolling interests and other .................................. (1,860) (95) (410)

Net cash flows from financing activities .......................................... (2,217) 8,125 233

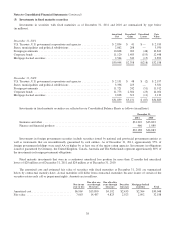

Effects of foreign currency exchange rate changes ...................................... 2 (74) 101

Increase (decrease) in cash and cash equivalents ....................................... (928) 7,669 5,019

Cash and cash equivalents at beginning of year ........................................ 38,227 30,558 25,539

Cash and cash equivalents at end of year * .......................................... $37,299 $ 38,227 $ 30,558

* Cash and cash equivalents at end of year are comprised of the following:

Insurance and Other ......................................................... $ 33,513 $ 34,767 $ 28,223

Railroad, Utilities and Energy ................................................. 2,246 2,557 429

Finance and Financial Products ................................................ 1,540 903 1,906

$ 37,299 $ 38,227 $ 30,558

See accompanying Notes to Consolidated Financial Statements

29