Berkshire Hathaway 2011 Annual Report Download - page 16

Download and view the complete annual report

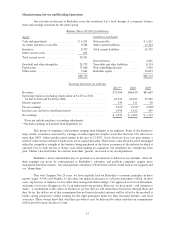

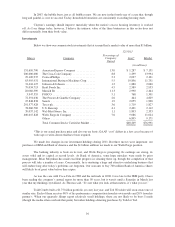

Please find page 16 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Jordan Hansell took over at NetJets in April and delivered 2011 pre-tax earnings of $227 million. That

is a particularly impressive performance because the sale of new planes was slow during most of the

year. In December, however, there was an uptick that was more than seasonally normal. How

permanent it will be is uncertain.

A few years ago NetJets was my number one worry: Its costs were far out of line with revenues, and

cash was hemorrhaging. Without Berkshire’s support, NetJets would have gone broke. These problems

are behind us, and Jordan is now delivering steady profits from a well-controlled and smoothly-running

operation. NetJets is proceeding on a plan to enter China with some first-class partners, a move that

will widen our business “moat.” No other fractional-ownership operator has remotely the size and

breadth of the NetJets operation, and none ever will. NetJets’ unrelenting focus on safety and service

has paid off in the marketplace.

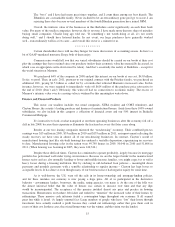

• It’s a joy to watch Marmon’s progress under Frank Ptak’s leadership. In addition to achieving internal

growth, Frank regularly makes bolt-on acquisitions that, in aggregate, will materially increase Marmon’s

earning power. (He did three, costing about $270 million, in the last few months.) Joint ventures around

the world are another opportunity for Marmon. At midyear Marmon partnered with the Kundalia family

in an Indian crane operation that is already delivering substantial profits. This is Marmon’s second

venture with the family, following a successful wire and cable partnership instituted a few years ago.

Of the eleven major sectors in which Marmon operates, ten delivered gains in earnings last year. You

can be confident of higher earnings from Marmon in the years ahead.

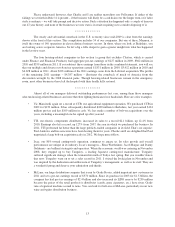

• “Buy commodities, sell brands” has long been a formula for business success. It has produced

enormous and sustained profits for Coca-Cola since 1886 and Wrigley since 1891. On a smaller scale,

we have enjoyed good fortune with this approach at See’s Candy since we purchased it 40 years ago.

Last year See’s had record pre-tax earnings of $83 million, bringing its total since we bought it to $1.65

billion. Contrast that figure with our purchase price of $25 million and our yearend carrying-value (net

of cash) of less than zero. (Yes, you read that right; capital employed at See’s fluctuates seasonally,

hitting a low after Christmas.) Credit Brad Kinstler for taking the company to new heights since he

became CEO in 2006.

• Nebraska Furniture Mart (80% owned) set an earnings record in 2011, netting more than ten times what

it did in 1983, when we acquired our stake.

But that’s not the big news. More important was NFM’s acquisition of a 433-acre tract north of Dallas

on which we will build what is almost certain to be the highest-volume home-furnishings store in the

country. Currently, that title is shared by our two stores in Omaha and Kansas City, each of which had

record-setting sales of more than $400 million in 2011. It will be several years before the Texas store is

completed, but I look forward to cutting the ribbon at the opening. (At Berkshire, the managers do the

work; I take the bows.)

Our new store, which will offer an unequalled variety of merchandise sold at prices that can’t be

matched, will bring huge crowds from near and far. This drawing power and our extensive holdings of

land at the site should enable us to attract a number of other major stores. (If any high-volume retailers

are reading this, contact me.)

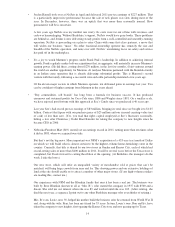

Our experience with NFM and the Blumkin family that runs it has been a real joy. The business was

built by Rose Blumkin (known to all as “Mrs. B”), who started the company in 1937 with $500 and a

dream. She sold me our interest when she was 89 and worked until she was 103. (After retiring, she

died the next year, a sequence I point out to any other Berkshire manager who even thinks of retiring.)

Mrs. B’s son, Louie, now 92, helped his mother build the business after he returned from World War II

and, along with his wife, Fran, has been my friend for 55 years. In turn, Louie’s sons, Ron and Irv, have

taken the company to new heights, first opening the Kansas City store and now gearing up for Texas.

14