Berkshire Hathaway 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

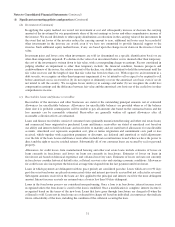

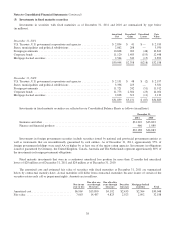

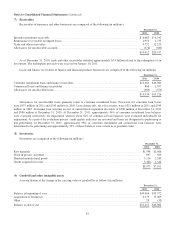

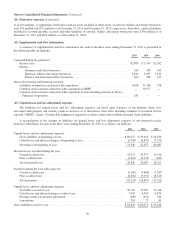

(4) Investments in equity securities

Investments in equity securities as of December 31, 2011 and 2010 are summarized based on the primary industry of the

investee in the table below (in millions).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2011

Banks, insurance and finance ........................................... $16,697 $ 9,480 $(1,269) $24,908

Consumer products ................................................... 12,390 14,320 — 26,710

Commercial, industrial and other ........................................ 20,523 4,973 (123) 25,373

$49,610 $28,773 $(1,392) $76,991

December 31, 2010

Banks, insurance and finance ........................................... $15,519 $ 9,549 $ (454) $24,614

Consumer products ................................................... 13,551 12,410 (212) 25,749

Commercial, industrial and other ........................................ 6,474 4,682 (6) 11,150

$35,544 $26,641 $ (672) $61,513

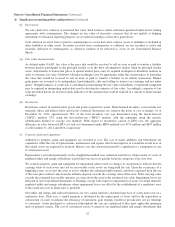

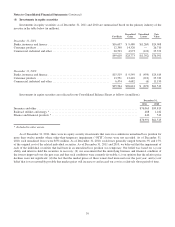

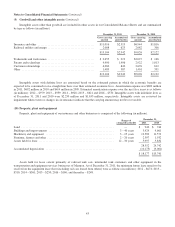

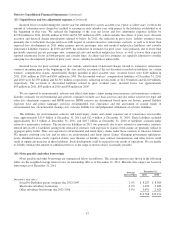

Investments in equity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2011 2010

Insurance and other ...................................................................... $76,063 $59,819

Railroad, utilities and energy * ............................................................. 488 1,182

Finance and financial products * ............................................................ 440 512

$76,991 $61,513

* Included in other assets.

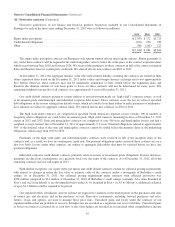

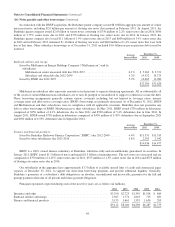

As of December 31, 2011, there were no equity security investments that were in a continuous unrealized loss position for

more than twelve months where other-than-temporary impairment (“OTTI”) losses were not recorded. As of December 31,

2010, such unrealized losses were $531 million. As of December 31, 2010, such losses generally ranged between 3% and 15%

of the original cost of the related individual securities. As of December 31, 2011 and 2010, we believed that the impairment of

each of the individual securities that had been in an unrealized loss position was temporary. Our belief was based on: (a) our

ability and intent to hold the securities to recovery; (b) our assessment that the underlying business and financial condition of

the issuers improved over the past year and that such conditions were currently favorable; (c) our opinion that the relative price

declines were not significant; (d) the fact that the market prices of these issuers had increased over the past year; and (e) our

belief that it was reasonably possible that market prices will increase to and exceed our cost in a relatively short period of time.

39