Berkshire Hathaway 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

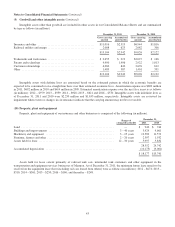

(i) Property, plant and equipment (Continued)

are subject to ASC 980 Regulated Operations also includes an equity allowance for funds used during construction.

Also see Note 1(p). Normal repairs and maintenance are charged to operating expense as incurred, while costs

incurred that extend the useful life of an asset, improve the safety of our operations, or improve operating efficiency

are capitalized. Rail grinding costs are expensed as incurred. Railroad properties are depreciated using the group

method in which a single depreciation rate is applied to the gross investment in a particular class of property, despite

differences in the service life or salvage value of individual property units within the same class.

(j) Goodwill

Goodwill represents the excess of the purchase price over the fair value of identifiable net assets acquired in business

acquisitions. We evaluate goodwill for impairment at least annually. When evaluating goodwill for impairment we

estimate the fair value of the reporting unit. There are several methods that may be used to estimate a reporting unit’s

fair value, including market quotations, asset and liability fair values and other valuation techniques, including, but

not limited to, discounted projected future net earnings or net cash flows and multiples of earnings. If the carrying

amount of a reporting unit, including goodwill, exceeds the estimated fair value, then the identifiable assets and

liabilities of the reporting unit are estimated at fair value as of the current testing date. The excess of the estimated fair

value of the reporting unit over the current estimated fair value of net assets establishes the implied value of goodwill.

The excess of the recorded goodwill over the implied goodwill value is charged to earnings as an impairment loss. A

significant amount of judgment is required in estimating the fair value of the reporting unit and performing goodwill

impairment tests.

(k) Revenue recognition

Insurance premiums for prospective property/casualty and health insurance and reinsurance are earned over the loss

exposure or coverage period, in proportion to the level of protection provided. In most cases, premiums are recognized

as revenues ratably over the term of the contract with unearned premiums computed on a monthly or daily pro rata

basis. Premiums for retroactive reinsurance property/casualty policies are earned at the inception of the contracts, as

all of the underlying loss events covered by these policies occurred in the past. Premiums for life reinsurance contracts

are earned when due. Premiums earned are stated net of amounts ceded to reinsurers. Premiums are estimated with

respect to certain reinsurance contracts where reports from ceding companies for the period are not contractually due

until after the balance sheet date. For contracts containing experience rating provisions, premiums are based upon

estimated loss experience under the contracts.

Sales revenues derive from the sales of manufactured products and goods acquired for resale. Revenues from sales are

recognized upon passage of title to the customer, which generally coincides with customer pickup, product delivery or

acceptance, depending on terms of the sales arrangement.

Service revenues are recognized as the services are performed. Services provided pursuant to a contract are either

recognized over the contract period or upon completion of the elements specified in the contract depending on the

terms of the contract. Revenues related to the sales of fractional ownership interests in aircraft are recognized ratably

over the term of the related management services agreement as the transfer of ownership interest in the aircraft is

inseparable from the management services agreement.

Interest income from investments in fixed maturity securities and loans is earned under the constant yield method and

includes accrual of interest due under terms of the agreement as well as amortization of acquisition premiums,

accruable discounts and capitalized loan origination fees, as applicable. In determining the constant yield for

mortgage-backed securities, anticipated counterparty prepayments are estimated and evaluated periodically. Dividends

from equity securities are recognized when earned, which is on the ex-dividend date or the declaration date, when

there is no ex-dividend date.

Operating revenue of utilities and energy businesses resulting from the distribution and sale of natural gas and

electricity to customers is recognized when the service is rendered or the energy is delivered. Amounts recognized

include unbilled as well as billed amounts. Rates charged are generally subject to federal and state regulation or

established under contractual arrangements. When preliminary rates are permitted to be billed prior to final approval

by the applicable regulator, certain revenue collected may be subject to refund and a liability for estimated refunds is

accrued.

33