Berkshire Hathaway 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

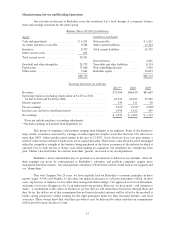

In 2007, the bubble burst, just as all bubbles must. We are now in the fourth year of a cure that, though

long and painful, is sure to succeed. Today, household formations are consistently exceeding housing starts.

Clayton’s earnings should improve materially when the nation’s excess housing inventory is worked

off. As I see things today, however, I believe the intrinsic value of the three businesses in this sector does not

differ materially from their book value.

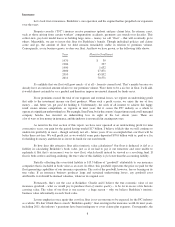

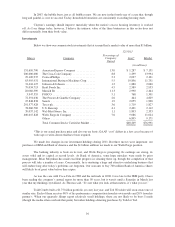

Investments

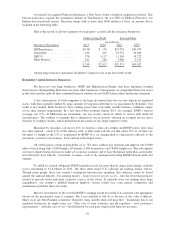

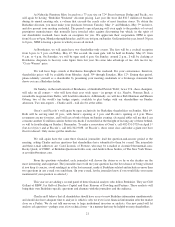

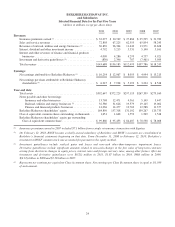

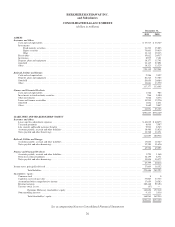

Below we show our common stock investments that at yearend had a market value of more than $1 billion.

12/31/11

Shares Company

Percentage of

Company

Owned

Cost* Market

(in millions)

151,610,700 American Express Company ............. 13.0 $ 1,287 $ 7,151

200,000,000 The Coca-Cola Company ................ 8.8 1,299 13,994

29,100,937 ConocoPhillips ........................ 2.3 2,027 2,121

63,905,931 International Business Machines Corp. ..... 5.5 10,856 11,751

31,416,127 Johnson & Johnson ..................... 1.2 1,880 2,060

79,034,713 Kraft Foods Inc. ....................... 4.5 2,589 2,953

20,060,390 Munich Re ........................... 11.3 2,990 2,464

3,947,555 POSCO .............................. 5.1 768 1,301

72,391,036 The Procter & Gamble Company .......... 2.6 464 4,829

25,848,838 Sanofi ............................... 1.9 2,055 1,900

291,577,428 Tesco plc ............................. 3.6 1,719 1,827

78,060,769 U.S. Bancorp ......................... 4.1 2,401 2,112

39,037,142 Wal-Mart Stores, Inc. ................... 1.1 1,893 2,333

400,015,828 Wells Fargo & Company ................ 7.6 9,086 11,024

Others ............................... 6,895 9,171

Total Common Stocks Carried at Market .... $48,209 $76,991

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases because of

write-ups or write-downs that have been required.

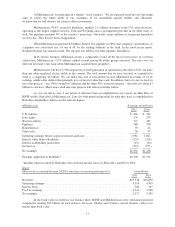

We made few changes in our investment holdings during 2011. But three moves were important: our

purchases of IBM and Bank of America and the $1 billion addition we made to our Wells Fargo position.

The banking industry is back on its feet, and Wells Fargo is prospering. Its earnings are strong, its

assets solid and its capital at record levels. At Bank of America, some huge mistakes were made by prior

management. Brian Moynihan has made excellent progress in cleaning these up, though the completion of that

process will take a number of years. Concurrently, he is nurturing a huge and attractive underlying business that

will endure long after today’s problems are forgotten. Our warrants to buy 700 million Bank of America shares

will likely be of great value before they expire.

As was the case with Coca-Cola in 1988 and the railroads in 2006, I was late to the IBM party. I have

been reading the company’s annual report for more than 50 years, but it wasn’t until a Saturday in March last

year that my thinking crystallized. As Thoreau said, “It’s not what you look at that matters, it’s what you see.”

Todd Combs built a $1.75 billion portfolio (at cost) last year, and Ted Weschler will soon create one of

similar size. Each of them receives 80% of his performance compensation from his own results and 20% from his

partner’s. When our quarterly filings report relatively small holdings, these are not likely to be buys I made

(though the media often overlook that point) but rather holdings denoting purchases by Todd or Ted.

16