Berkshire Hathaway 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

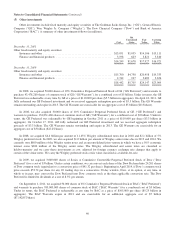

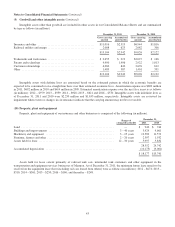

Notes to Consolidated Financial Statements (Continued)

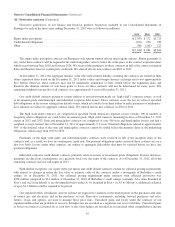

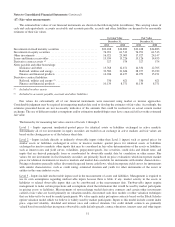

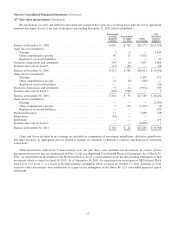

(11) Derivative contracts (Continued)

or in net earnings, as appropriate. Derivative contract assets included in other assets of railroad, utilities and energy businesses

were $71 million and $231 million as of December 31, 2011 and December 31, 2010, respectively. Derivative contract liabilities

included in accounts payable, accruals and other liabilities of railroad, utilities and energy businesses were $336 million as of

December 31, 2011 and $621 million as of December 31, 2010.

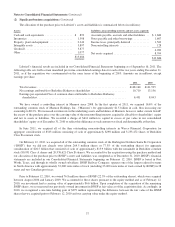

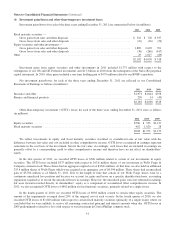

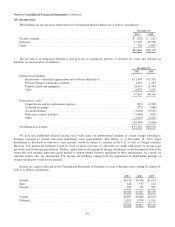

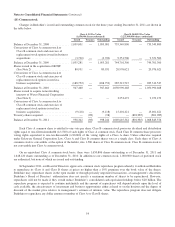

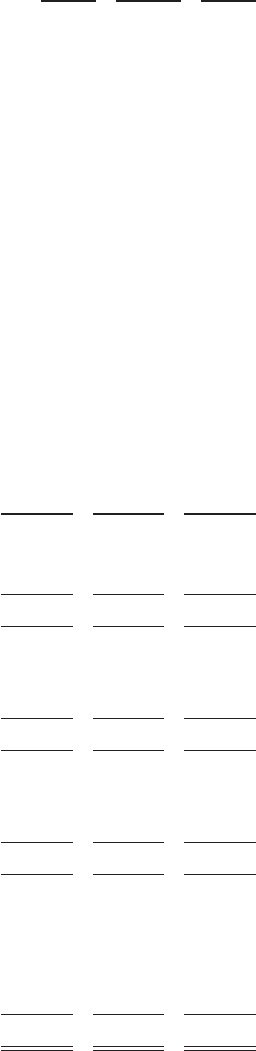

(12) Supplemental cash flow information

A summary of supplemental cash flow information for each of the three years ending December 31, 2011 is presented in

the following table (in millions).

2011 2010 2009

Cash paid during the period for:

Income taxes ................................................................. $2,885 $ 3,547 $2,032

Interest:

Insurance and other businesses .............................................. 243 185 145

Railroad, utilities and energy businesses ....................................... 1,821 1,667 1,142

Finance and financial products businesses ...................................... 662 708 615

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions .................................. 5,836 31,406 278

Common stock issued in connection with acquisition of BNSF ......................... — 10,577 —

Common stock issued in connection with acquisition of noncontrolling interests in Wesco

Financial Corporation ........................................................ 245 — —

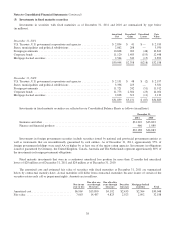

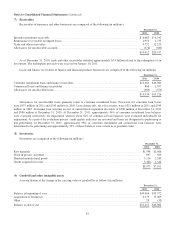

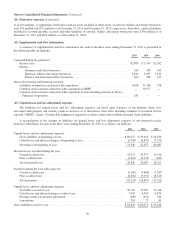

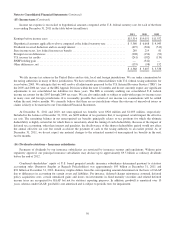

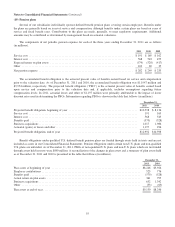

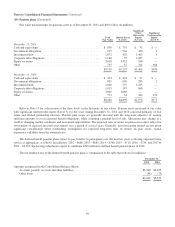

(13) Unpaid losses and loss adjustment expenses

The liabilities for unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs

associated with property and casualty claim occurrences as of the balance sheet dates including estimates for incurred but not

reported (“IBNR”) claims. Considerable judgment is required to evaluate claims and establish estimated claim liabilities.

A reconciliation of the changes in liabilities for unpaid losses and loss adjustment expenses of our property/casualty

insurance subsidiaries for each of the three years ending December 31, 2011 is as follows (in millions).

2011 2010 2009

Unpaid losses and loss adjustment expenses:

Gross liabilities at beginning of year .......................................... $60,075 $ 59,416 $ 56,620

Ceded losses and deferred charges at beginning of year ........................... (6,545) (6,879) (7,133)

Net balance at beginning of year ............................................. 53,530 52,537 49,487

Incurred losses recorded during the year:

Current accident year ...................................................... 23,031 20,357 19,156

Prior accident years ....................................................... (2,202) (2,270) (905)

Total incurred losses ...................................................... 20,829 18,087 18,251

Payments during the year with respect to:

Current accident year ...................................................... (9,269) (7,666) (7,207)

Prior accident years ....................................................... (8,854) (9,191) (8,315)

Total payments ........................................................... (18,123) (16,857) (15,522)

Unpaid losses and loss adjustment expenses:

Net balance at end of year .................................................. 56,236 53,767 52,216

Ceded losses and deferred charges at end of year ................................ 7,092 6,545 6,879

Foreign currency translation adjustment ....................................... (100) (312) 232

Acquisitions ............................................................. 591 75 89

Gross liabilities at end of year ................................................... $63,819 $ 60,075 $ 59,416

46