Berkshire Hathaway 2011 Annual Report Download - page 38

Download and view the complete annual report

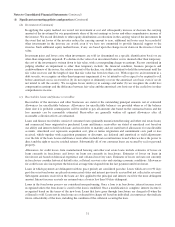

Please find page 38 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(t) New accounting pronouncements (Continued)

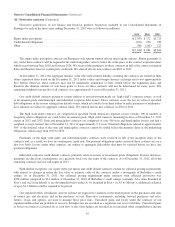

In October 2010, the FASB issued ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing

Insurance Contracts.” ASU 2010-26 modifies the types of costs that may be deferred in the acquiring or renewing of

insurance contracts. ASU 2010-26 specifies that only direct incremental costs related to successful efforts should be

capitalized. Capitalized costs include certain advertising costs which may be capitalized if the primary purpose of the

advertising is to elicit sales to customers who could be shown to have responded directly to the advertising and the

probable future revenues generated from the advertising are in excess of expected future costs to be incurred in

realizing those revenues. ASU 2010-26 is effective for Berkshire beginning January 1, 2012 and will be applied on a

prospective basis.

In May 2011, the FASB issued ASU 2011-04, “Amendments to Achieve Common Fair Value Measurement and

Disclosure Requirements in U.S. GAAP and IFRSs.” The amendments in ASU 2011-04 clarify the intent of the

application of existing fair value measurement and disclosure requirements, as well as change certain measurement

requirements and disclosures. ASU 2011-04 is effective for Berkshire beginning January 1, 2012 and will be applied

on a prospective basis.

In June 2011, the FASB issued ASU 2011-05, “Presentation of Comprehensive Income.” ASU 2011-05 changes the

way other comprehensive income (“OCI”) is presented within the financial statements. Financial statements will be

required to reflect net income, OCI and total comprehensive income in one continuous statement or in two separate

but consecutive statements. The accompanying Consolidated Financial Statements show net earnings, OCI and total

comprehensive income in two separate, but consecutive statements. In December 2011, the FASB issued ASU

2011-12 that deferred the provisions of ASU 2011-05 relating to the requirement to report reclassification adjustments

between OCI and net earnings in the statements of earnings.

In September 2011, the FASB issued ASU 2011-08, “Testing Goodwill for Impairment.” ASU 2011-08 allows an

entity to first assess qualitative factors in determining whether it is necessary to perform the two-step quantitative

goodwill impairment test. Only if an entity determines that it is more likely than not that the fair value of a reporting

unit is less than its carrying amount based on qualitative factors, would it be required to then perform the first step of

the two-step quantitative goodwill impairment test. ASU 2011-08 is effective for and will be applied by Berkshire

beginning January 1, 2012.

In December 2011, the FASB issued ASU 2011-11 “Disclosures about Offsetting Assets and Liabilities.” ASU

2011-11 enhances disclosures surrounding offsetting (netting) assets and liabilities. The standard applies to financial

instruments and derivatives and requires companies to disclose both gross and net information about instruments and

transactions eligible for offset in the statement of financial position and instruments and transactions subject to a

master netting arrangement. ASU 2011-11 is effective retrospectively for Berkshire beginning January 1, 2013. We

are still evaluating the effect this standard will have on our Consolidated Financial Statements.

Except as otherwise disclosed, we do not believe that the adoption of these new pronouncements will have a material

effect on our Consolidated Financial Statements.

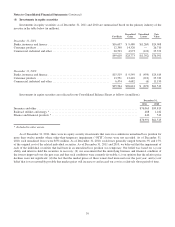

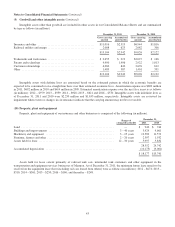

(2) Significant business acquisitions

Our long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able

and honest management at sensible prices.

On March 13, 2011, Berkshire and The Lubrizol Corporation (“Lubrizol”) entered into a merger agreement, whereby

Berkshire would acquire all of the outstanding shares of Lubrizol common stock for cash of $135 per share (approximately $8.7

billion in the aggregate). The merger was completed on September 16, 2011. Lubrizol, based in Cleveland, Ohio, is an

innovative specialty chemical company that produces and supplies technologies to customers in the global transportation,

industrial and consumer markets. These technologies include additives for engine oils, other transportation-related fluids and

industrial lubricants, as well as additives for gasoline and diesel fuel. In addition, Lubrizol makes ingredients and additives for

personal care products and pharmaceuticals; specialty materials, including plastics; and performance coatings. Lubrizol’s

industry-leading technologies in additives, ingredients and compounds enhance the quality, performance and value of

customers’ products, while reducing their environmental impact.

36