Berkshire Hathaway 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Financial Condition (Continued)

Our railroad, utilities and energy businesses (conducted by BNSF and MidAmerican) maintain very large investments in

capital assets (property, plant and equipment) and will regularly make capital expenditures in the normal course of business. In

2011, MidAmerican’s capital expenditures were approximately $2.7 billion, which excluded approximately $750 million of

non-cash property and equipment additions that were offset by a corresponding amount of debt or other liabilities. BNSF’s

capital expenditures in 2011 were approximately $3.3 billion. MidAmerican’s forecasted capital expenditures for 2012 are $3.8

billion, while BNSF’s forecasted capital expenditures are approximately $3.9 billion. Future capital expenditures are expected to

be funded from cash flows from operations and debt issuances. In 2011, BNSF issued debt of $1.5 billion with maturities in

2021 and 2041, and its outstanding debt increased $685 million to $12.7 billion as of December 31. In 2011, MidAmerican’s

new borrowings were $1.4 billion and its aggregate outstanding borrowings increased $269 million to $19.9 billion at

December 31. MidAmerican and BNSF have aggregate debt and capital lease maturities in 2012 of $2.6 billion. Berkshire has

committed until February 28, 2014 to provide up to $2 billion of additional capital to MidAmerican to permit the repayment of

its debt obligations or to fund its regulated utility subsidiaries. Berkshire does not guarantee the repayment of debt issued by

BNSF, MidAmerican or any of their subsidiaries.

Assets of the finance and financial products businesses, which consisted primarily of loans and finance receivables, fixed

maturity securities, other investments and cash and cash equivalents were approximately $25.0 billion as of December 31, 2011

and $25.7 billion at December 31, 2010. Liabilities were approximately $25.4 billion as of December 31, 2011 and $24.0 billion

as of December 31, 2010. As of December 31, 2011, notes payable and other borrowings of $14.0 billion included

approximately $11.5 billion of notes issued by Berkshire Hathaway Finance Corporation (“BHFC”). In January 2011, BHFC

issued $1.5 billion of notes and repaid $1.5 billion of maturing notes. In January 2012, $250 million of BHFC notes matured and

an additional $2.45 billion will mature in the second and third quarters of 2012. BHFC notes are unsecured and maturities

currently range from 2012 to 2040. The proceeds from the BHFC notes are used to finance originated and acquired loans of

Clayton Homes. The full and timely payment of principal and interest on the BHFC notes is guaranteed by Berkshire.

We regularly access the credit markets, particularly through our parent company and through our railroad, utilities and

energy and the finance and financial products businesses. Restricted access to credit markets at affordable rates in the future

could have a significant negative impact on our operations.

On July 21, 2010, President Obama signed into law financial regulatory reform legislation, known as the Dodd-Frank Wall

Street Reform and Consumer Protection Act (the “Reform Act”). The Reform Act reshapes financial regulations in the United

States by creating new regulators, regulating new markets and market participants and providing new enforcement powers to

regulators. Virtually all major areas of the Reform Act will be subject to regulatory interpretation and implementation rules

requiring rulemaking that may take several years to complete.

We are party to several equity index put option and credit default contracts as described in Note 11 to the Consolidated

Financial Statements. With limited exception, these contracts contain no collateral posting requirements under any

circumstances, including changes in either the fair value or intrinsic value of the contracts or a downgrade in Berkshire’s credit

ratings. Substantially all of these contracts were entered into prior to December 31, 2008. At December 31, 2011, the liabilities

recorded for these contracts were approximately $10.0 billion and our collateral posting requirements were $238 million. With

respect to such collateral requirements, we receive the income attributable to such collateral or, in certain instances, interest

credit from the counterparty. Although the ultimate outcome of the regulatory rulemaking proceedings described in the

preceding paragraph cannot be predicted with certainty, we do not believe that the provisions of the Reform Act that concern

collateral requirements apply to derivatives contracts that were entered into prior to the enactment of the Reform Act, as ours

were. As such, although the Reform Act may adversely affect some of our business activities, it is not currently expected to

have a material impact on our consolidated financial results or financial condition.

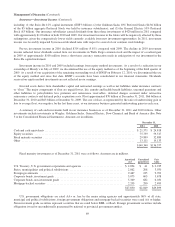

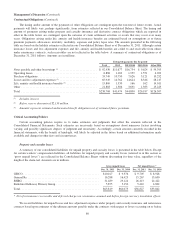

Contractual Obligations

We are party to contracts associated with ongoing business and financing activities, which will result in cash payments to

counterparties in future periods. Certain obligations reflected in our Consolidated Balance Sheets, such as notes payable, require

future payments on contractually specified dates and in fixed and determinable amounts. Other obligations pertain to the

acquisition of goods or services in the future, which are not currently reflected in the financial statements, such as minimum

rentals under operating leases. Such obligations will be reflected in future periods as the goods are delivered or services

provided. Amounts due as of the balance sheet date for purchases where the goods and services have been received and a

liability incurred are not included to the extent that such amounts are due within one year of the balance sheet date.

79