Berkshire Hathaway 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

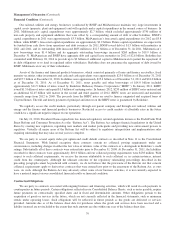

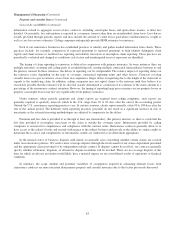

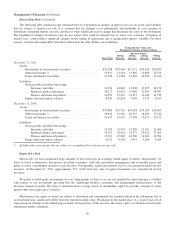

Contractual Obligations (Continued)

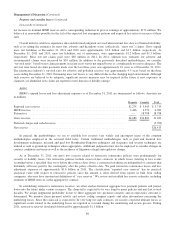

The timing and/or amount of the payments of other obligations are contingent upon the outcome of future events. Actual

payments will likely vary, perhaps significantly, from estimates reflected in our Consolidated Balance Sheet. The timing and

amount of payments arising under property and casualty insurance and derivative contract obligations which are reported in

other in the table below are contingent upon the outcome of claim settlement activities or events that may occur over many

years. Obligations arising under life, annuity and health insurance benefits are estimated based on assumptions as to future

premium payments, allowances, mortality, morbidity, expenses and policy lapse rates. The amounts presented in the following

table are based on the liability estimates reflected in our Consolidated Balance Sheet as of December 31, 2011. Although certain

insurance losses and loss adjustment expenses and life, annuity and health benefits are ceded to and receivable from others

under reinsurance contracts, such receivables are not reflected in the table below. A summary of contractual obligations as of

December 31, 2011 follows. Amounts are in millions.

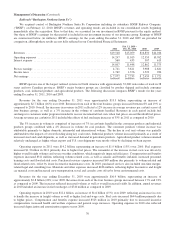

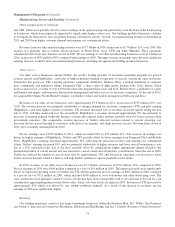

Estimated payments due by period

Total 2012 2013-2014 2015-2016 After 2016

Notes payable and other borrowings (1) .......................... $ 92,430 $11,677 $16,734 $ 9,624 $ 54,395

Operating leases ............................................ 8,888 1,169 1,959 1,551 4,209

Purchase obligations ......................................... 33,749 10,750 7,626 5,121 10,252

Losses and loss adjustment expenses (2) .......................... 65,949 14,762 14,624 8,346 28,217

Life, annuity and health insurance benefits (3) ..................... 15,869 1,530 166 162 14,011

Other ..................................................... 21,883 1,586 3,691 1,383 15,223

Total ..................................................... $238,768 $41,474 $44,800 $26,187 $126,307

(1) Includes interest.

(2) Before reserve discounts of $2,130 million.

(3) Amounts represent estimated undiscounted benefit obligations net of estimated future premiums.

Critical Accounting Policies

Certain accounting policies require us to make estimates and judgments that affect the amounts reflected in the

Consolidated Financial Statements. Such estimates are necessarily based on assumptions about numerous factors involving

varying, and possibly significant, degrees of judgment and uncertainty. Accordingly, certain amounts currently recorded in the

financial statements, with the benefit of hindsight, will likely be adjusted in the future based on additional information made

available and changes in other facts and circumstances.

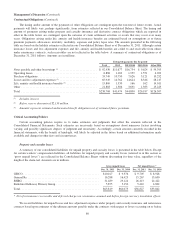

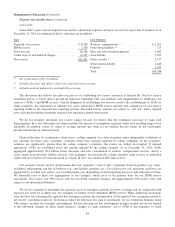

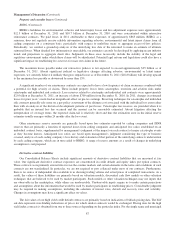

Property and casualty losses

A summary of our consolidated liabilities for unpaid property and casualty losses is presented in the table below. Except

for certain workers’ compensation liabilities, all liabilities for unpaid property and casualty losses (referred to in this section as

“gross unpaid losses”) are reflected in the Consolidated Balance Sheets without discounting for time value, regardless of the

length of the claim-tail. Amounts are in millions.

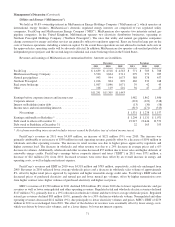

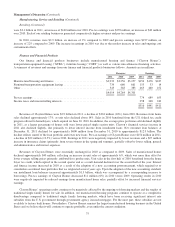

Gross unpaid losses Net unpaid losses *

Dec. 31, 2011 Dec. 31, 2010 Dec. 31, 2011 Dec. 31, 2010

GEICO ..................................................... $10,167 $ 9,376 $ 9,705 $ 8,928

General Re .................................................. 16,288 16,425 15,267 15,690

BHRG ..................................................... 31,489 29,124 26,413 24,422

Berkshire Hathaway Primary Group .............................. 5,875 5,150 5,442 4,802

Total ....................................................... $63,819 $60,075 $56,827 $53,842

* Net of reinsurance recoverable and deferred charges on reinsurance assumed and before foreign currency translation effects.

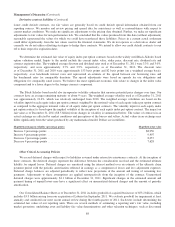

We record liabilities for unpaid losses and loss adjustment expenses under property and casualty insurance and reinsurance

contracts based upon estimates of the ultimate amounts payable under the contracts with respect to losses occurring on or before

80