Berkshire Hathaway 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(p) Regulated utilities and energy businesses (Continued)

Regulatory assets and liabilities are continually assessed for probable future inclusion in regulatory rates by

considering factors such as applicable regulatory or legislative changes and recent rate orders received by other

regulated entities. If future inclusion in regulatory rates ceases to be probable, the amount no longer probable of

inclusion in regulatory rates is charged to earnings or reflected as an adjustment to rates.

(q) Life, annuity and health insurance benefits

The liability for insurance benefits under life contracts has been computed based upon estimated future investment

yields, expected mortality, morbidity, and lapse or withdrawal rates and reflects estimates for future premiums and

expenses under the contracts. These assumptions, as applicable, also include a margin for adverse deviation and may

vary with the characteristics of the reinsurance contract’s date of issuance, policy duration and country of risk. The

interest rate assumptions used may vary by reinsurance contract or jurisdiction and generally range from

approximately 3% to 7%. Annuity contracts are discounted based on the implicit rate of return as of the inception of

the contracts and such interest rates range from approximately 1% to 7%.

(r) Foreign currency

The accounts of our non-U.S. based subsidiaries are measured in most instances using the local currency of the

subsidiary as the functional currency. Revenues and expenses of these businesses are generally translated into U.S.

Dollars at the average exchange rate for the period. Assets and liabilities are translated at the exchange rate as of the

end of the reporting period. Gains or losses from translating the financial statements of foreign-based operations are

included in shareholders’ equity as a component of accumulated other comprehensive income. Gains and losses

arising from transactions denominated in a currency other than the functional currency of the entity that is party to the

transaction are included in earnings.

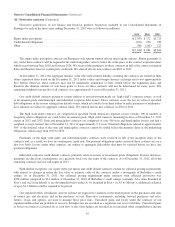

(s) Income taxes

We file a consolidated federal income tax return in the United States, which includes our eligible subsidiaries. In

addition, we file income tax returns in state, local and foreign jurisdictions as applicable. Provisions for current

income tax liabilities are calculated and accrued on income and expense amounts expected to be included in the

income tax returns for the current year.

Deferred income taxes are calculated under the liability method. Deferred income tax assets and liabilities are based

on differences between the financial statement and tax basis of assets and liabilities at the enacted tax rates. Changes

in deferred income tax assets and liabilities that are associated with components of other comprehensive income are

charged or credited directly to other comprehensive income. Otherwise, changes in deferred income tax assets and

liabilities are included as a component of income tax expense. Changes in deferred income tax assets and liabilities

attributable to changes in enacted tax rates are charged or credited to income tax expense in the period of enactment.

Valuation allowances are established for certain deferred tax assets where realization is not likely.

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax

returns when such positions are judged to not meet the “more-likely-than-not” threshold based on the technical merits

of the positions. Estimated interest and penalties related to uncertain tax positions are generally included as a

component of income tax expense.

(t) New accounting pronouncements

Pursuant to FASB Accounting Standards Update (“ASU”) 2010-06, in 2011 we began disclosing the gross activity in

assets and liabilities measured on a recurring basis using significant Level 3 inputs. Also beginning in 2011, we

adopted ASU 2010-28 which modified Step 1 of the goodwill impairment test for reporting units with zero or negative

carrying amounts. For those reporting units, Step 2 of the goodwill impairment test is required if it is more likely than

not that a goodwill impairment exists, after considering whether there are any adverse qualitative factors indicating

that an impairment may exist. The adoption of these standards did not have a material impact on our Consolidated

Financial Statements.

35