Berkshire Hathaway 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Please understand, however, that Charlie and I are neither masochists nor Pollyannas. If either of the

failings we set forth in Rule 11 is present – if the business will likely be a cash drain over the longer term, or if labor

strife is endemic – we will take prompt and decisive action. Such a situation has happened only a couple of times in

our 47-year history, and none of the businesses we now own is in straits requiring us to consider disposing of it.

************

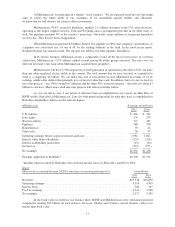

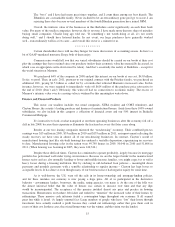

The steady and substantial comeback in the U.S. economy since mid-2009 is clear from the earnings

shown at the front of this section. This compilation includes 54 of our companies. But one of these, Marmon, is

itself the owner of 140 operations in eleven distinct business sectors. In short, when you look at Berkshire, you

are looking across corporate America. So let’s dig a little deeper to gain a greater insight into what has happened

in the last few years.

The four housing-related companies in this section (a group that excludes Clayton, which is carried

under Finance and Financial Products) had aggregate pre-tax earnings of $227 million in 2009, $362 million in

2010 and $359 million in 2011. If you subtract these earnings from those in the combined statement, you will see

that our multiple and diverse non-housing operations earned $1,831 million in 2009, $3,912 million in 2010 and

$4,678 million in 2011. About $291 million of the 2011 earnings came from the Lubrizol acquisition. The profile

of the remaining 2011 earnings – $4,387 million – illustrates the comeback of much of America from the

devastation wrought by the 2008 financial panic. Though housing-related businesses remain in the emergency

room, most other businesses have left the hospital with their health fully restored.

************

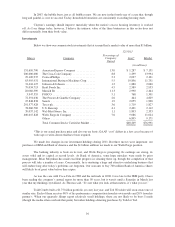

Almost all of our managers delivered outstanding performances last year, among them those managers

who run housing-related businesses and were therefore fighting hurricane-force headwinds. Here are a few examples:

• Vic Mancinelli again set a record at CTB, our agricultural equipment operation. We purchased CTB in

2002 for $139 million. It has subsequently distributed $180 million to Berkshire, last year earned $124

million pre-tax and has $109 million in cash. Vic has made a number of bolt-on acquisitions over the

years, including a meaningful one he signed up after yearend.

• TTI, our electric components distributor, increased its sales to a record $2.1 billion, up 12.4% from

2010. Earnings also hit a record, up 127% from 2007, the year in which we purchased the business. In

2011, TTI performed far better than the large publicly-traded companies in its field. That’s no surprise:

Paul Andrews and his associates have been besting them for years. Charlie and I are delighted that Paul

negotiated a large bolt-on acquisition early in 2012. We hope more follow.

• Iscar, our 80%-owned cutting-tools operation, continues to amaze us. Its sales growth and overall

performance are unique in its industry. Iscar’s managers – Eitan Wertheimer, Jacob Harpaz and Danny

Goldman – are brilliant strategists and operators. When the economic world was cratering in November

2008, they stepped up to buy Tungaloy, a leading Japanese cutting-tool manufacturer. Tungaloy

suffered significant damage when the tsunami hit north of Tokyo last spring. But you wouldn’t know

that now: Tungaloy went on to set a sales record in 2011. I visited the Iwaki plant in November and

was inspired by the dedication and enthusiasm of Tungaloy’s management, as well as its staff. They are

a wonderful group and deserve your admiration and thanks.

• McLane, our huge distribution company that is run by Grady Rosier, added important new customers in

2011 and set a pre-tax earnings record of $370 million. Since its purchase in 2003 for $1.5 billion, the

company has had pre-tax earnings of $2.4 billion and also increased its LIFO reserve by $230 million

because the prices of the retail products it distributes (candy, gum, cigarettes, etc.) have risen. Grady

runs a logistical machine second to none. You can look for bolt-ons at McLane, particularly in our new

wine-and-spirits distribution business.

13