Berkshire Hathaway 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

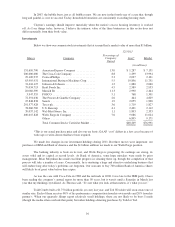

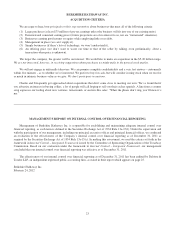

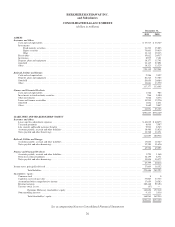

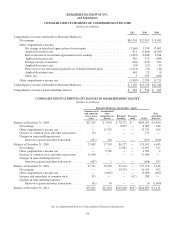

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

December 31,

2011 2010

ASSETS

Insurance and Other:

Cash and cash equivalents ..................................................................................... $ 33,513 $ 34,767

Investments:

Fixed maturity securities ................................................................................... 31,222 33,803

Equity securities ......................................................................................... 76,063 59,819

Other .................................................................................................. 13,111 19,333

Receivables ................................................................................................. 19,012 20,917

Inventories .................................................................................................. 8,975 7,101

Property, plant and equipment .................................................................................. 18,177 15,741

Goodwill ................................................................................................... 32,125 27,891

Other ...................................................................................................... 18,121 13,529

250,319 232,901

Railroad, Utilities and Energy:

Cash and cash equivalents ..................................................................................... 2,246 2,557

Property, plant and equipment .................................................................................. 82,214 77,385

Goodwill ................................................................................................... 20,056 20,084

Other ...................................................................................................... 12,861 13,579

117,377 113,605

Finance and Financial Products:

Cash and cash equivalents ..................................................................................... 1,540 903

Investments in fixed maturity securities ........................................................................... 966 1,080

Other investments ............................................................................................ 3,810 3,676

Loans and finance receivables .................................................................................. 13,934 15,226

Goodwill ................................................................................................... 1,032 1,031

Other ...................................................................................................... 3,669 3,807

24,951 25,723

$392,647 $372,229

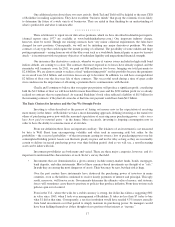

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses ............................................................................. $ 63,819 $ 60,075

Unearned premiums .......................................................................................... 8,910 7,997

Life, annuity and health insurance benefits ........................................................................ 9,924 8,565

Accounts payable, accruals and other liabilities ..................................................................... 18,466 15,826

Notes payable and other borrowings .............................................................................. 13,768 12,471

114,887 104,934

Railroad, Utilities and Energy:

Accounts payable, accruals and other liabilities ..................................................................... 13,016 12,367

Notes payable and other borrowings .............................................................................. 32,580 31,626

45,596 43,993

Finance and Financial Products:

Accounts payable, accruals and other liabilities ..................................................................... 1,224 1,168

Derivative contract liabilities ................................................................................... 10,139 8,371

Notes payable and other borrowings .............................................................................. 14,036 14,477

25,399 24,016

Income taxes, principally deferred ................................................................................... 37,804 36,352

Total liabilities ...................................................................................... 223,686 209,295

Shareholders’ equity:

Common stock .............................................................................................. 8 8

Capital in excess of par value ................................................................................... 37,807 37,533

Accumulated other comprehensive income ........................................................................ 17,654 20,583

Retained earnings ............................................................................................ 109,448 99,194

Treasury stock, at cost ......................................................................................... (67) —

Berkshire Hathaway shareholders’ equity ................................................................. 164,850 157,318

Noncontrolling interests ....................................................................................... 4,111 5,616

Total shareholders’ equity .............................................................................. 168,961 162,934

$392,647 $372,229

See accompanying Notes to Consolidated Financial Statements

26