Berkshire Hathaway 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

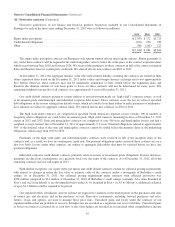

(14) Notes payable and other borrowings (Continued)

In connection with the BNSF acquisition, the Berkshire parent company issued $8.0 billion aggregate par amount of senior

unsecured notes, including $2.0 billion par amount of floating rate notes that matured in February 2011. In August 2011, the

Berkshire parent company issued $2.0 billion of senior notes consisting of $750 million of 2.2% senior notes due in 2016, $500

million of 3.75% senior notes due in 2021 and $750 million of floating rate senior notes due in 2014. In January 2012, the

Berkshire parent company also issued $1.1 billion of 1.9% senior notes due in 2017 and $600 million of 3.4% senior notes due

in 2022 and in February 2012 redeemed $1.1 billion of floating rate notes and $600 million of 1.4% senior notes that were both

due at that time. Other subsidiary borrowings as of December 31, 2011 included $1.6 billion in pre-acquisition debt issued by

Lubrizol.

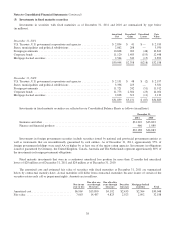

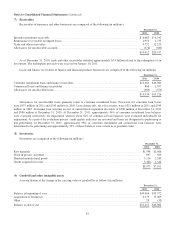

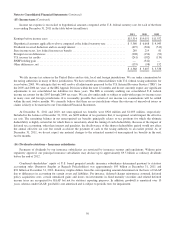

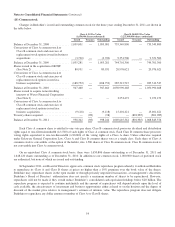

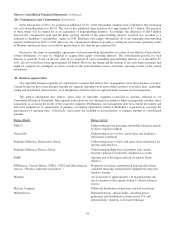

Average

Interest Rate

December 31,

2011 2010

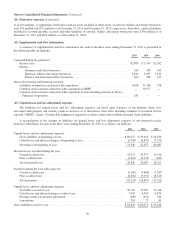

Railroad, utilities and energy:

Issued by MidAmerican Energy Holdings Company (“MidAmerican”) and its

subsidiaries:

MidAmerican senior unsecured debt due 2012-2037 ......................... 6.1% $ 5,363 $ 5,371

Subsidiary and other debt due 2012-2039 .................................. 5.2% 14,552 14,275

Issued by BNSF due 2012-2097 ............................................. 5.9% 12,665 11,980

$32,580 $31,626

MidAmerican subsidiary debt represents amounts issued pursuant to separate financing agreements. All or substantially all

of the assets of certain MidAmerican subsidiaries are or may be pledged or encumbered to support or otherwise secure the debt.

These borrowing arrangements generally contain various covenants including, but not limited to, leverage ratios, interest

coverage ratios and debt service coverage ratios. BNSF’s borrowings are primarily unsecured. As of December 31, 2011, BNSF

and MidAmerican and their subsidiaries were in compliance with all applicable covenants. Berkshire does not guarantee any

debt or other borrowings of BNSF, MidAmerican or their subsidiaries. In May 2011, BNSF issued $750 million in debentures

comprised of $250 million of 4.1% debentures due in June 2021 and $500 million of 5.4% debentures due in June 2041. In

August 2011, BNSF issued $750 million in debentures comprised of $450 million of 3.45% debentures due in September 2021

and $300 million of 4.95% debentures due in September 2041.

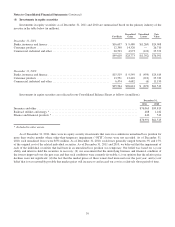

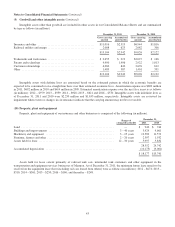

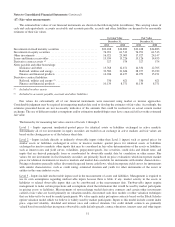

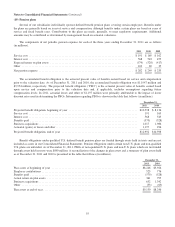

Average

Interest Rate

December 31,

2011 2010

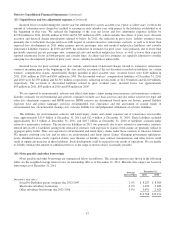

Finance and financial products:

Issued by Berkshire Hathaway Finance Corporation (“BHFC”) due 2012-2040 ........ 4.4% $11,531 $11,535

Issued by other subsidiaries due 2012-2036 .................................... 4.8% 2,505 2,942

$14,036 $14,477

BHFC is a 100% owned finance subsidiary of Berkshire, which has fully and unconditionally guaranteed its securities. In

January 2011, BHFC issued $1.5 billion of notes and repaid $1.5 billion of maturing notes. The new notes are unsecured and are

comprised of $750 million of 4.25% senior notes due in 2021, $375 million of 1.5% senior notes due in 2014 and $375 million

of floating rate senior notes due in 2014.

Our subsidiaries in the aggregate have approximately $3.7 billion of available unused lines of credit and commercial paper

capacity at December 31, 2011, to support our short-term borrowing programs and provide additional liquidity. Generally,

Berkshire’s guarantee of a subsidiary’s debt obligation is an absolute, unconditional and irrevocable guarantee for the full and

prompt payment when due of all present and future payment obligations.

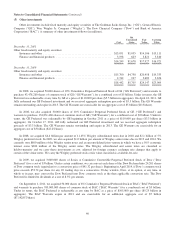

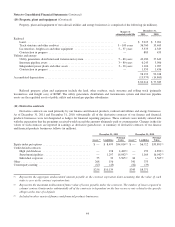

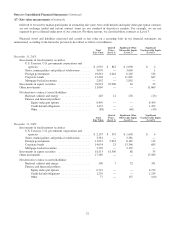

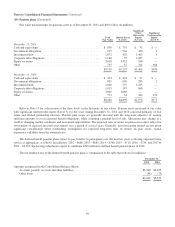

Principal repayments expected during each of the next five years are as follows (in millions).

2012 2013 2014 2015 2016

Insurance and other ................................................. $3,390 $2,725 $1,345 $1,918 $ 869

Railroad, utilities and energy .......................................... 2,567 1,774 1,618 713 681

Finance and financial products ......................................... 3,155 3,661 1,335 1,656 205

$9,112 $8,160 $4,298 $4,287 $1,755

48