Berkshire Hathaway 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions (Continued)

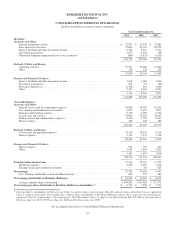

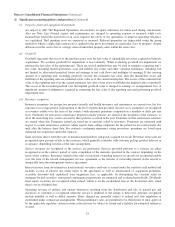

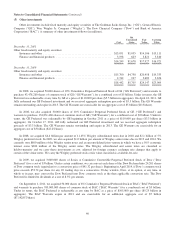

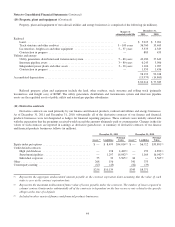

The allocation of the purchase price to Lubrizol’s assets and liabilities is summarized below (in millions):

Assets:

Cash and cash equivalents ................... $ 893

Inventories ............................... 1,598

Property, plant and equipment ................ 2,344

Intangible assets ........................... 3,897

Goodwill ................................. 3,877

Other .................................... 1,077

$13,686

Liabilities, noncontrolling interests and net assets acquired:

Accounts payable, accruals and other liabilities . . $ 1,684

Notes payable and other borrowings ........... 1,607

Income taxes, principally deferred ............. 1,563

Noncontrolling interests ..................... 128

4,982

Net assets acquired ......................... 8,704

$13,686

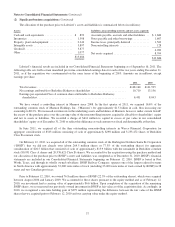

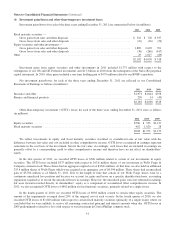

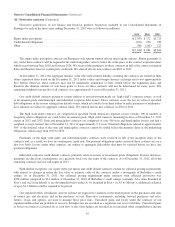

Lubrizol’s financial results are included in our Consolidated Financial Statements beginning as of September 16, 2011. The

following table sets forth certain unaudited pro forma consolidated earnings data for each of the two years ending December 31,

2011, as if the acquisition was consummated on the same terms at the beginning of 2010. Amounts are in millions, except

earnings per share.

2011 2010

Total revenues .............................................................. $148,160 $141,595

Net earnings attributable to Berkshire Hathaway shareholders ........................ 10,710 13,156

Earnings per equivalent Class A common share attributable to Berkshire Hathaway

shareholders .............................................................. 6,491 8,043

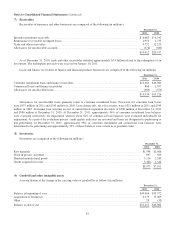

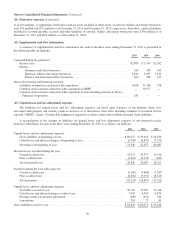

We have owned a controlling interest in Marmon since 2008. In the first quarter of 2011, we acquired 16.6% of the

outstanding common stock of Marmon Holdings, Inc. (“Marmon”) for approximately $1.5 billion in cash, thus increasing our

ownership to 80.2%. We increased our interests in the underlying assets and liabilities of Marmon; however, under current GAAP,

the excess of the purchase price over the carrying value of the noncontrolling interests acquired is allocable to shareholders’ equity

and not to assets or liabilities. We recorded a charge of $614 million to capital in excess of par value in our consolidated

shareholders’ equity as of December 31, 2010 to reflect this difference as such amount was fixed and determinable at that date.

In June 2011, we acquired all of the then outstanding noncontrolling interests in Wesco Financial Corporation for

aggregate consideration of $543 million consisting of cash of approximately $298 million and 3,253,472 shares of Berkshire

Class B common stock.

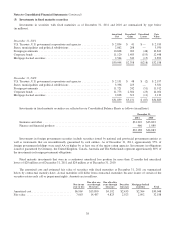

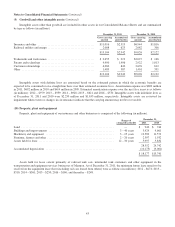

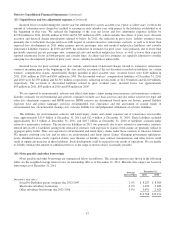

On February 12, 2010, we acquired all of the outstanding common stock of the Burlington Northern Santa Fe Corporation

(“BNSF”) that we did not already own (about 264.5 million shares or 77.5% of the outstanding shares) for aggregate

consideration of $26.5 billion that consisted of cash of approximately $15.9 billion with the remainder in Berkshire common

stock (80,931 Class A shares and 20,976,621 Class B shares). We accounted for the acquisition using the purchase method and

our allocation of the purchase price to BNSF’s assets and liabilities was completed as of December 31, 2010. BNSF’s financial

statements are included in our Consolidated Financial Statements beginning on February 12, 2010. BNSF is based in Fort

Worth, Texas, and through its wholly owned subsidiary, BNSF Railway Company, operates one of the largest railroad systems

in North America with approximately 32,000 route miles of track (including 23,000 route miles of track owned by BNSF) in 28

states and two Canadian provinces.

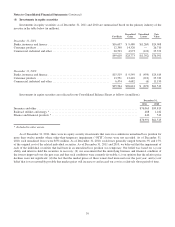

Prior to February 12, 2010, we owned 76.8 million shares of BNSF (22.5% of the outstanding shares), which were acquired

between August 2006 and January 2009. We accounted for those shares pursuant to the equity method and as of February 12,

2010, our investment had a carrying value of approximately $6.6 billion. Upon completion of the acquisition of the remaining

BNSF shares, we re-measured our previously owned investment in BNSF at fair value as of the acquisition date. Accordingly, in

2010, we recognized a one-time holding gain of $979 million representing the difference between the fair value of the BNSF

shares that we acquired prior to February 12, 2010 and our carrying value under the equity method.

37