Berkshire Hathaway 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

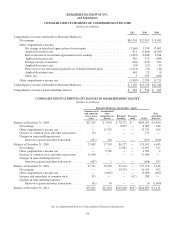

Notes to Consolidated Financial Statements (Continued)

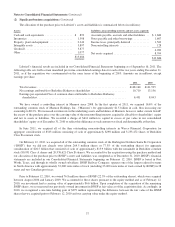

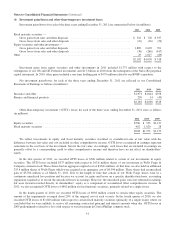

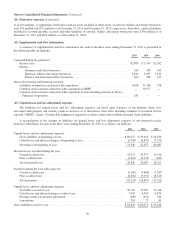

(3) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2011 and 2010 are summarized by type below

(in millions).

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2011

U.S. Treasury, U.S. government corporations and agencies ................... $ 2,894 $ 41 $ — $ 2,935

States, municipalities and political subdivisions ............................ 2,862 208 — 3,070

Foreign governments ................................................. 10,608 283 (48) 10,843

Corporate bonds ..................................................... 11,120 1,483 (155) 12,448

Mortgage-backed securities ............................................ 2,564 343 (15) 2,892

$30,048 $2,358 $(218) $32,188

December 31, 2010

U.S. Treasury, U.S. government corporations and agencies ................... $ 2,151 $ 48 $ (2) $ 2,197

States, municipalities and political subdivisions ............................ 3,356 225 — 3,581

Foreign governments ................................................. 11,721 242 (51) 11,912

Corporate bonds ..................................................... 11,773 2,304 (23) 14,054

Mortgage-backed securities ............................................ 2,838 312 (11) 3,139

$31,839 $3,131 $ (87) $34,883

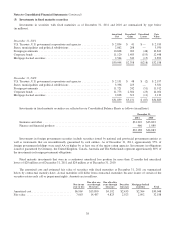

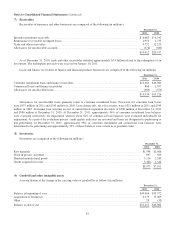

Investments in fixed maturity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2011 2010

Insurance and other ............................................................ $31,222 $33,803

Finance and financial products ................................................... 966 1,080

$32,188 $34,883

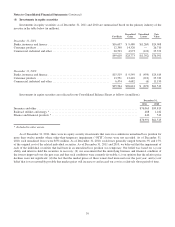

Investments in foreign government securities include securities issued by national and provincial government entities as

well as instruments that are unconditionally guaranteed by such entities. As of December 31, 2011, approximately 95% of

foreign government holdings were rated AA or higher by at least one of the major rating agencies. Investments in obligations

issued or guaranteed by Germany, the United Kingdom, Canada, Australia and The Netherlands represent approximately 80% of

the investments in foreign government obligations.

Fixed maturity investments that were in a continuous unrealized loss position for more than 12 months had unrealized

losses of $20 million as of December 31, 2011 and $24 million as of December 31, 2010.

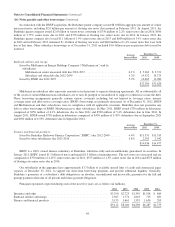

The amortized cost and estimated fair value of securities with fixed maturities at December 31, 2011 are summarized

below by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the

securities retain early call or prepayment rights. Amounts are in millions.

Due in one

year or less

Due after one

year through

five years

Due after five

years through

ten years

Due after

ten years

Mortgage-backed

securities Total

Amortized cost ........................... $6,969 $13,890 $4,192 $2,433 $2,564 $30,048

Fair value ............................... 7,063 14,487 4,823 2,923 2,892 32,188

38