Berkshire Hathaway 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At MidAmerican, we participate in a similar “social compact.” We are expected to put up ever-increasing

sums to satisfy the future needs of our customers. If we meanwhile operate reliably and efficiently,

we know that we will obtain a fair return on these investments.

MidAmerican, 89.8% owned by Berkshire, supplies 2.5 million customers in the U.S. with electricity,

operating as the largest supplier in Iowa, Utah and Wyoming and as an important provider in six other states as

well. Our pipelines transport 8% of the country’s natural gas. Obviously, many millions of Americans depend on

us every day. They haven’t been disappointed.

When MidAmerican purchased Northern Natural Gas pipeline in 2002, that company’s performance as

a pipeline was rated dead last, 43 out of 43, by the leading authority in the field. In the most recent report,

Northern Natural was ranked second. The top spot was held by our other pipeline, Kern River.

In its electric business, MidAmerican has a comparable record. In the most recent survey of customer

satisfaction, MidAmerican’s U.S. utilities ranked second among 60 utility groups surveyed. The story was far

different not many years back when MidAmerican acquired these properties.

MidAmerican will have 3,316 megawatts of wind generation in operation by the end of 2012, far more

than any other regulated electric utility in the country. The total amount that we have invested or committed to

wind is a staggering $6 billion. We can make this sort of investment because MidAmerican retains all of its

earnings, unlike other utilities that generally pay out most of what they earn. In addition, late last year we took on

two solar projects – one 100%-owned in California and the other 49%-owned in Arizona – that will cost about $3

billion to construct. Many more wind and solar projects will almost certainly follow.

As you can tell by now, I am proud of what has been accomplished for our society by Matt Rose at

BNSF and by Greg Abel at MidAmerican. I am also both proud and grateful for what they have accomplished for

Berkshire shareholders. Below are the relevant figures:

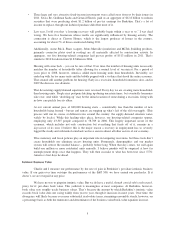

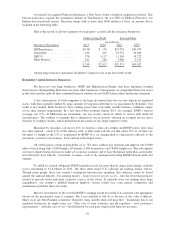

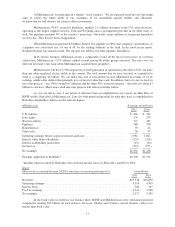

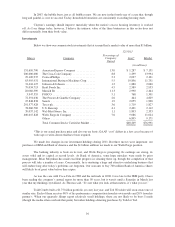

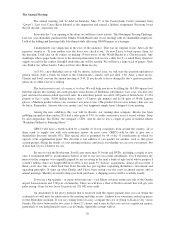

MidAmerican Earnings (in millions)

2011 2010

U.K. utilities ............................................................. $ 469 $ 333

Iowa utility .............................................................. 279 279

Western utilities .......................................................... 771 783

Pipelines ................................................................ 388 378

HomeServices ............................................................ 39 42

Other (net) ............................................................... 36 47

Operating earnings before corporate interest and taxes ............................ 1,982 1,862

Interest, other than to Berkshire .............................................. (323) (323)

Interest on Berkshire junior debt .............................................. (13) (30)

Income tax ............................................................... (315) (271)

Net earnings ............................................................. $1,331 $1,238

Earnings applicable to Berkshire* ............................................ $1,204 $1,131

*Includes interest earned by Berkshire (net of related income taxes) of $8 in 2011 and $19 in 2010.

BNSF

(Historical accounting through 2/12/10; purchase accounting subsequently) (in millions)

2011 2010

Revenues ................................................................ $19,548 $16,850

Operating earnings ........................................................ 5,310 4,495

Interest (Net) ............................................................. 560 507

Pre-Tax earnings .......................................................... 4,741 3,988

Net earnings .............................................................. 2,972 2,459

In the book value recorded on our balance sheet, BNSF and MidAmerican carry substantial goodwill

components totaling $20 billion. In each instance, however, Charlie and I believe current intrinsic value is far

greater than book value.

11