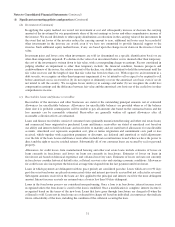

Berkshire Hathaway 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

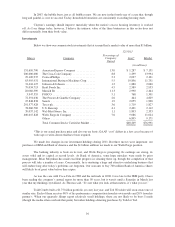

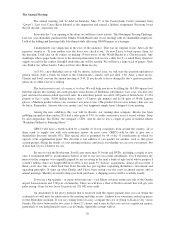

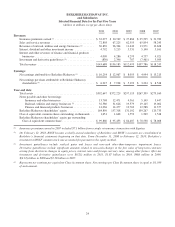

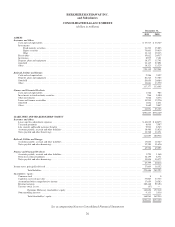

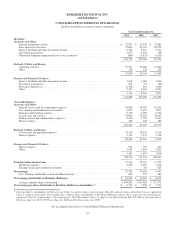

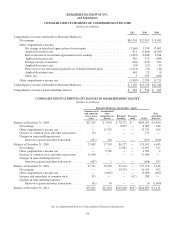

BERKSHIRE HATHAWAY INC.

and Subsidiaries

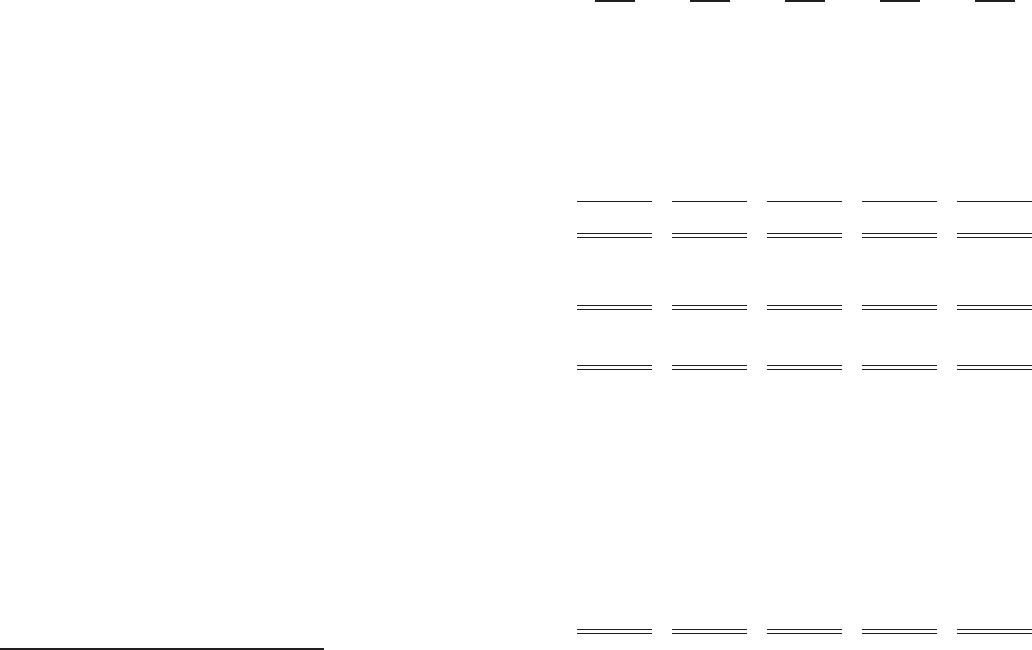

Selected Financial Data for the Past Five Years

(dollars in millions except per-share data)

2011 2010 2009 2008 2007

Revenues:

Insurance premiums earned (1) ........................... $ 32,075 $ 30,749 $ 27,884 $ 25,525 $ 31,783

Sales and service revenues .............................. 72,803 67,225 62,555 65,854 58,243

Revenues of railroad, utilities and energy businesses (2) ....... 30,839 26,364 11,443 13,971 12,628

Interest, dividend and other investment income ............. 4,792 5,215 5,531 5,140 5,161

Interest and other revenues of finance and financial products

businesses ......................................... 4,009 4,286 4,293 4,757 4,921

Investment and derivative gains/losses (3) .................. (830) 2,346 787 (7,461) 5,509

Total revenues ....................................... $143,688 $136,185 $112,493 $107,786 $118,245

Earnings:

Net earnings attributable to Berkshire Hathaway (3) .......... $ 10,254 $ 12,967 $ 8,055 $ 4,994 $ 13,213

Net earnings per share attributable to Berkshire Hathaway

shareholders (4) ..................................... $ 6,215 $ 7,928 $ 5,193 $ 3,224 $ 8,548

Year-end data:

Total assets .......................................... $392,647 $372,229 $297,119 $267,399 $273,160

Notes payable and other borrowings:

Insurance and other businesses ...................... 13,768 12,471 4,561 5,149 3,447

Railroad, utilities and energy businesses (2) ............. 32,580 31,626 19,579 19,145 19,002

Finance and financial products businesses .............. 14,036 14,477 13,769 12,588 11,377

Berkshire Hathaway shareholders’ equity .................. 164,850 157,318 131,102 109,267 120,733

Class A equivalent common shares outstanding, in thousands . . 1,651 1,648 1,552 1,549 1,548

Berkshire Hathaway shareholders’ equity per outstanding

Class A equivalent common share ...................... $ 99,860 $ 95,453 $ 84,487 $ 70,530 $ 78,008

(1) Insurance premiums earned in 2007 included $7.1 billion from a single reinsurance transaction with Equitas.

(2) On February 12, 2010, BNSF became a wholly-owned subsidiary of Berkshire and BNSF’s accounts are consolidated in

Berkshire’s financial statements beginning on that date. From December 31, 2008 to February 12, 2010, Berkshire’s

investment in BNSF common stock was accounted for pursuant to the equity method.

(3) Investment gains/losses include realized gains and losses and non-cash other-than-temporary impairment losses.

Derivative gains/losses include significant amounts related to non-cash changes in the fair value of long-term contracts

arising from short-term changes in equity prices, interest rates and foreign currency rates, among other factors. After-tax

investment and derivative gains/losses were $(521) million in 2011, $1.87 billion in 2010, $486 million in 2009,

$(4.65) billion in 2008 and $3.58 billion in 2007.

(4) Represents net earnings per equivalent Class A common share. Net earnings per Class B common share is equal to 1/1,500

of such amount.

24